Insights & Opinions

Automation in banking: when virtual assistants become virtual colleagues

Thu, 20 May 2021

Although RPA (Robotics Process Automation) exists for some time, it is only in the last five years that banks massively adopted the technology. It put the business more in the driver’s seat of their own wishes to a more performant banking environment with higher customer satisfaction.

It is just the start of the path to the automated bank. The front runners added new tools through intelligent automation, and they are now investigating tomorrow’s solutions for even more automation.

The first blog on our May 6-session explained how ING Wholesale Banking and NIBC Bank started their automation journey and the key drivers why they did so. We learned that automation increased employee engagement and both banks ended up with more time to improve their services and more accurate planning to serve their customers better.

Their focus is now shifting from RPA to adding more intelligent solutions, and they are investigating how robots can help them detect the next processes to automate.

Adding intelligence in the loop when RPA falls short

Sudhanshu Sawlani, Head of Robotics and Intelligent Automation at ING Wholesale Banking, defined RPA as “Something that mimics human action, something that can be rule-based, with a manageable number of rules, like 10-15 rules. If the process has too many variants, it is not a candidate for RPA. Then, instead of building a rule-based solution, you can instead opt for a model-based solution, which comes into the different landscape of Intelligent Automation and AI.”

Intelligent automation helps a bot think and execute. Machine learning, OCR and visual recognition, natural language processing are a few examples of what intelligent automation can add.

Banks with a solid cloud strategy have a head start, as cloud providers have many services off-the-shelf available for their clients. NIBC Bank works with UiPathfor RPA, but they see the value of these solutions growing exponentially by linking RPA to OCR solutions or natural language processing, for example. Features like digital passport recognition for customer onboarding is readily available in the cloud and waiting for integration.

Jelle van Munster, Process Automation Lead at NIBC Bank: “In the future, it will help us to develop more complex automation solutions and make them available within our production environment combined with the process automation through RPA. That’s really something we are looking forward to.”

Intelligent automation and hyperautomation

Adding new tools and new possibilities creates new value propositions and opportunities for banks. On March 25th, we heard of Sezgin Lüle, Deputy CEO of İşbank, sharing their customised pricing through intelligent automation as an exciting example of that. Analysing the various data points of each individual customer made the robot define an optimal price. It increased revenues, improved customer experience, and cut the bias and decision power of sales agents out of the process.

In the same discussion, we also heard Nicolas Boitout, Head of CoE in “AI, Analytics & Automation” at Société Générale GSC, being more sceptical about AI in the process, especially in the process of email classification. He said: “AI should be the ultimate solution that we put in place where we have no other way of changing a process, changing the user, the user experience and the user interface”.

Sudhanshu’s experience was more positive. He argues that human classification would be about 80%-85% accurate compared to 95% accuracy if the machines classify the emails. The 5% of emails that a robot cannot classify is transferred to people for human intervention, lifting the end result even more.

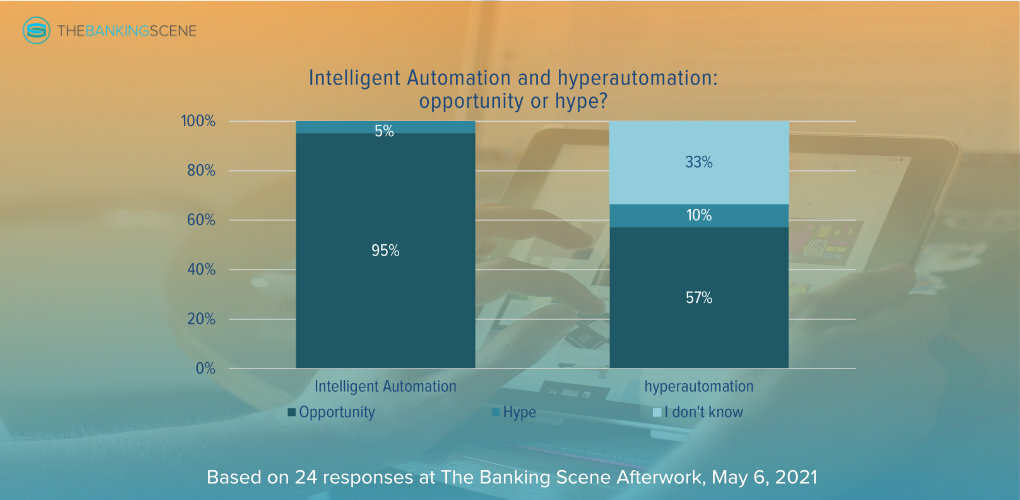

Our experts obviously inspired the audience, with 95% saying intelligent automation is an opportunity (compared to 75% of the audience in the session on March 25th). Jelle agreed with their sentiment, but he was also mindful to ensure good governance when exposing to the opportunities of AI. Especially in the context of hyperautomation, the industry is only at the beginning of the learning curve.

From the beginning, the team at NIBC Bank involved internal audit and operational risk management, so they were engaged and joined the reflections and brainstorms on the opportunities and the risks of these new technological evolutions and what the impact could be for the organisation.

Hyperautomation remains a black box for many. Sudhanshu explained it as fast-paced automation at scale to get quick results for which one needs a much bigger toolkit than pure RPA. Gone are the days for organisations like ING Wholesale Banking to look for low-hanging fruit through automation manually.

More advanced technologies will augment the process automation team to find new opportunities that the human eye cannot detect. Automated process discovery is an essential part of that fast-paced automation, where you leave bots looking for the right opportunities to a higher degree of process excellence.

Sudhanshu: “They say automation is the automation of a single task. But orchestration is the automation of series of tasks, one after the other. And that’s what you want to achieve with hyperautomation. So there is a lot of opportunities out there. But you have to do it right, not just get carried away with the hype.”

A well-orchestrated framework will help a bank find the best solution for each opportunity, whether RPA, AI, a rules-based engine, an API, or anything else.

Like ING Wholesale Banking, NIBC Bank is currently exploring automated process discovery, and they will keep adding intelligence in their automation solutions. Once the process requires judgement, AI is added to the loop. They already master OCR and NLP technologies and look for more AI solutions to augment what RPA adds to the organisation.

“We are constantly working on strengthening our toolkit to provide intelligent solutions across the bank. These are the means to get to the results we want to achieve: happier employees. Our focus in the bank is to create better employees and higher engagement across the organisation, and as a result, of course, to have satisfied customers.”

Conclusion

As bank employees get more accustomed to digital assistants, and RPA is increasingly more part of the day-to-day work, the industry is looking for more intelligent automation solutions. On top of helping a hand, they start adding brains, that way evolving to become genuine colleagues. The fact that now robots are figuring out where more robots can add value is exciting, and honestly, I don’t know where all this will end.

What I do know is that these are exciting times, and RPA, intelligent automation and hyperautomation may not be the sexiest notions, but keep an eye on them because they are transforming the way we look at banking and the way the end-customer is looking at them!

Make sure you free your agenda on September 9th, when we welcome Chris Skinner, author and commentator at The Finanser and Nitin Purwar, Director Banking Industry Practice at UiPath to discuss "Automation for Good: Automation as an enabler for ESG and Sustainability in Banks."