Insights & Opinions

Today's hottest topics in innovation in retail payments and cards

Tue, 20 Apr 2021

Every discussion on payments surprises me how fast, and slow, this industry moves ahead. This was not different around the virtual round table on April 15, in partnership with Radar Payments. Fifty people worldwide joined the session and shared their views on innovations in the cards and payments space. What is shaking the cards and payments industry? Which market dynamics force banks and PSPs to review their business?

I am thankful for the international audience that made me rethink certain biases and helped me better understand specific needs and expectations from the market.

Our special guest for this session was Peter Theunis, Co-CEO of Radar Payments and “a 20-year encyclopedia” on the wonderful world of payments. For this first blog dedicated to that session, I will dig deeper into today’s hottest topics. Next week, I’ll share a second blog explaining how banks and PSPs should cope with these conclusions in their payments and cards strategy.

The biggest disruptive forces in retail payments

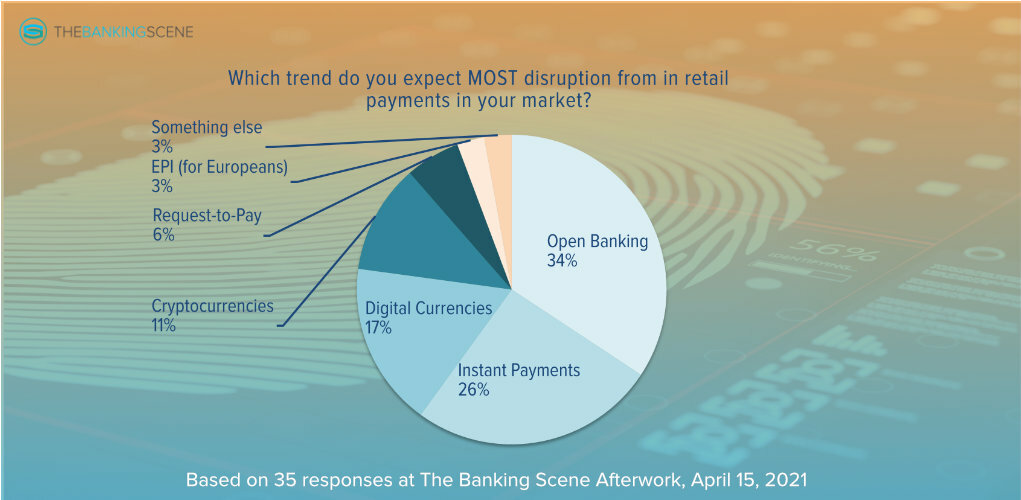

The awareness of the slow pace of change hit me when I saw the results of the poll in which we asked the audience to name the trend where they expect most disruption from in retail payments. I bet that 70% of the feedback had been similar if we asked the question 5 years ago.

34% expected most disruption to come from open banking, 26% from instant payments. Peter: “In traditional retail payments, where we use the card, instant payments have a tremendous opportunity to take this over in most cases.” The hard part, according to him, is to convince the merchant side about yet another payment option.

A few people rightfully noted that the combination of both, open banking and instant payments, would change retail payments the most, probably in combination with a third force, namely request-to-pay.

Despite the many years of discussion, Request-to-Pay (RTP) remains relatively unknown. The European Payments Council defines RTP as the set of operating rules and technical elements (including messages) that allow a Payee (or creditor) to claim an amount of money from a Payer (debtor) for a specific transaction. The combination of RTP with open banking and instant payments has the fundaments to make credit transfers an alternative for card payments, P2P solutions and even e-invoicing and direct debits.

Digital currencies closed the top-3.

The biggest card disruptor

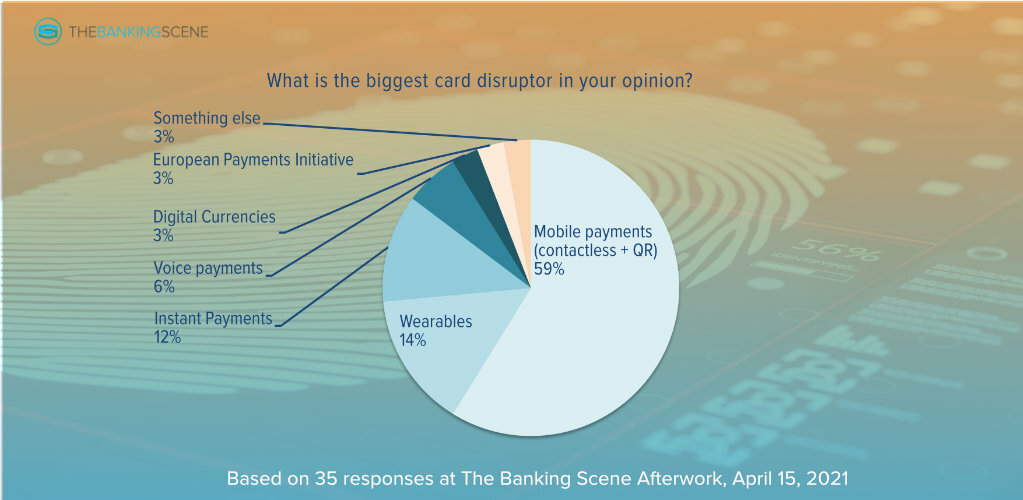

Mobile remains the dominant technology to disrupt the cards business, according to our audience (59%), more than wearables (14%) or voice payments (6%).

Peter agreed with the 59%, saying: “With mobile, you don’t have only the cards, you also have the instant payments, you can do QR codes, you can do request-to-pay. Calling with a mobile phone is one of the less used functionalities on a mobile phone today. It is more our whole life is running in there. What is the only thing we never forget when we leave home? That is the mobile. I forget my wallet more than my mobile phone.”

Yet, when we asked him by which year he would expect mobile payments to be taking 30% market share in Europe at Point-of-Sale, he answered 2035 the earliest. To put that into contact: that is 14 more years or the same lifetime as the iPhone today.

QR-codes have seen a revival over the last years. It looks like my years-long argument against QR codes proved invalid: that it was too cryptic for consumers to use it massively in the West.

Digital currencies were hardly worth mentioning, probably because most experts see cards as a form factor that may well be required to initiate digital currency transactions in the future.

The biggest surprise to me here was the limited 3% audience that saw EPI as the biggest card disruptor. EPI stands for “European Payments Initiative”, 31 European banks/credit institutions and 2 third-party acquirers launched this initiative to create a new pan-European payment solution leveraging Instant Payments and cards”.

Despite the official support of 70% of the private payments market, veterans in the industry remain reluctant. Only 27% of our European audience gave the project a 50% chance or more during this session.

Peter’s personal opinion, with 20 years of professional experience in the cards market, was: “I think it never succeeded before, and this time, it will be difficult again. You have carte Bancaire de France, and you have Bancontact in Belgium, Eurocard in Germany and many other local solutions. Making EPI successful means that every country has to give up (some of) their local identity.”

Even with the support of 70% of the cards issuing market, the chicken and egg problem remains: creating acceptance is much harder to realise. Payconiq may be reaching international scale by taking over Digicash in Luxembourg, merging with Bancontact in Belgium and providing the infrastructure for Currence in the Netherlands. Still, it remains a Benelux setting at this stage, like P27 is a Nordics initiative. They haven’t overcome the cultural chaullenge in a way they must to have full European coverage.

Someone from the audience noted that a sustainable business case is another serious challenge. Global players like Mastercard, Visa and Paypal have enormous pockets to invest in product development and marketing. Can the European organisations behind EPI make a voice against these global powers to ensure the success of a European competitor?

The end of cards is(n’t) near

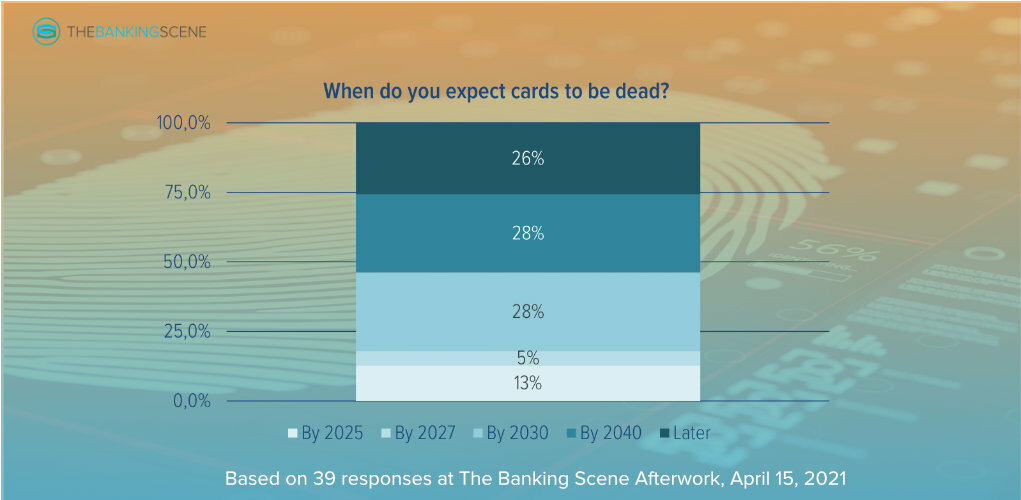

Every time we ask a question for the expert in the registration process to access the Afterwork sessions. The most asked question this time was: “when will cards be dead?” So we asked the expert… after posing everyone for their opinion in a poll on the same question.

To my surprise, 5 out of 39 answered that cards would no longer be used by 2025, or 12,8% of the respondents. This percentage grew to 46% of the audience, saying cards to be dead by 2030.

Cards will still be there for a while. The open discussion we had on April 15 demonstrated that cards are more than just a form factor. The popularity of Platinum cards is not only coming from the convenience of the higher limits or the safety from the insurance products that are included. It is mainly because of the status that they represent.

A representative from the GCC (Gulf Cooperation Council) shared that the physical design of the cards remains very important in their country. People like to show their cards to friends, just like they do with a new phone.

Peter’s insights based on his experiences in South-East Asia and Africa were even more striking: “I think the card for many people is not only about the card, but it is the only token that they have that links them with the bank.”

We often forget these dimensions when we discuss cards from our own context, but they are essential when designing a card strategy for consumers. They don’t think like a payments expert.

Conclusion

In summary, I think it is safe to say that a lot is moving in the fascinating world of payments, some dynamics faster than others. It is hard to predict what comes next and which horses to bet on. Will mobile payments grow further, or can we expect more invisible payment means anytime soon? Will we keep paying in euro or will it be a digital euro in the future and how will this impact our payment behaviour and management?

In the next blog, we share how banks and PSPs can cope with that in their strategy.