Insights & Opinions

Transforming the Rules of Engagement in Wealth Management

Thu, 18 Jul 2024

In the vibrant world of finance, especially within wealth management, the traditional rules of engagement are getting a serious makeover. Recently, Jean-Baptiste Beaux, Business Development Manager at Comarch, took the stage at The Banking Scene Conference 2024 Brussels, to share his pearls of wisdom on boosting customer lifetime value (CLV) with a mix of innovative and engaging strategies to bring banks back at the forefront of customer engagement.

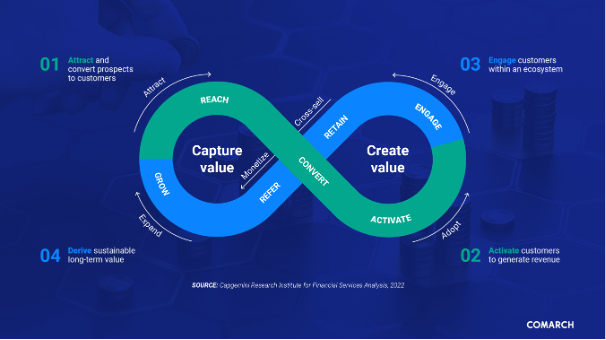

The essence of the presentation was that by leading in customer engagement, wealth management firms will also lead in CLV, defined as a predictive metric used by businesses to estimate the total revenue they can expect from a customer over the entire duration of their relationship. It helps companies understand the long-term value of their customer base and make informed decisions about marketing, sales, and customer service investments.

Redefining The Customer Lifecycle

Let's start with the basics: the customer lifecycle. Imagine it as a journey with three clear stages. First up is customer acquisition, the grand entrance where you attract and onboard new clients. It's a crucial step, but here's the kicker—it's the most expensive part of the journey. To stand out from the competition, sales and marketing are essential, and that comes at a cost.

Next, we move to customer engagement, where the magic truly begins. This stage is all about getting clients to actively participate and make their initial investments.

Finally, we reach customer retention, the long game. This is where you maintain and nurture those precious relationships, turning one-time investors into lifelong patrons.

Jean-Baptiste highlighted a common pitfall many financial institutions face: devoting too much attention to acquiring new customers while neglecting their existing ones. This approach isn’t just costly—it’s also a missed opportunity. Did you know it’s five times more expensive to acquire a new customer than to keep an existing one?

Plus, the odds of selling to an existing customer are significantly higher: 60-70% chance of selling to an existing customer, compared to 5-20% for a new prospect. So, why not balance the scales with a robust retention strategy?

Maximising Customer Lifetime Value

So, how can we avoid that pitfall? What is the trick to maximising CLV? CLV is a nifty little metric that predicts the total revenue a business can expect from a customer over their entire relationship. It’s like a financial crystal ball. CLV is made up of three key elements:

- the average purchase value

- purchase frequency rate

- average customer lifetime.

Each of these can be fine-tuned to make every customer relationship more profitable.

Increasing the average purchase value might involve offering personalised advice or a wider range of investment options, like Robo-advisory services. Boosting the purchase frequency rate could mean setting up periodic investment plans or regularly pushing personalised investment ideas. And extending the average customer lifetime? That’s all about adopting a holistic, customer-centric approach, tailoring services to different life stages to keep clients engaged for the long haul.

Redefining The Rules of Engagement

But how do you put all this into action? Jean-Baptiste shared some of Comarch’s secret weapons for driving customer loyalty and retention. First, there are personalised investment ideas. Imagine campaigns so tailored to customer profiles and preferences that the investment propositions are irresistible.

Then there’s the gamification of loyalty programs. Drawing inspiration from retail and aviation, these programs reward customers for good financial behaviour, turning mundane money management into an engaging game. Jean-Baptiste came with the example of Old Mutual from South Africa which, by leveraging Comarch’s loyalty solution, has nailed this with a program that encourages clients to improve their financial health while rewarding them with points, discounts, and more.

And let's not forget personalised videos. These aren’t your run-of-the-mill marketing clips. They’re short, interactive movies that use customer data to deliver personalised messages, updates, and investment recommendations. Picture this: a video that greets you by name, updates you on your portfolio, and suggests new investment opportunities—all tailored just for you. It’s no wonder these videos capture attention and drive deeper engagement.

"Personalized videos are a game-changer," Jean-Baptiste enthused. "They offer a unique, interactive way to communicate with customers, making them feel valued and understood."

As much as this sounds very expensive, we will see further democratisation of this thanks to the current developments in AI, which brings down the cost of both video creation and understanding the customer to bring them the right video at the right time. The return? Up to 85% of users will watch a personalised video compared to only 15% for a non-personalised one.

As Jean-Baptiste wrapped up his presentation, he left the audience with some key insights. While customer acquisition is important, focusing on engagement and retention is where the real value lies. The wealth management sector is brimming with potential for fostering active, loyal customers through innovative techniques. By leveraging digital tools like gamification and personalized videos, financial institutions can significantly enhance the customer experience and increase CLV.

"There’s a huge potential within the wealth management industry to leverage customer engagement strategies," Jean-Baptiste explained. "A balanced focus on acquisition and retention can transform short-term gains into long-term profitability."

Conclusion

In the ever-changing landscape of wealth management, embracing a customer-centric approach and utilising cutting-edge tools can transform engagement and retention efforts, leading to sustained profitability. Jean-Baptiste Beaux’s insights provide a roadmap for financial institutions looking to navigate this dynamic environment and rewrite the rules of engagement in wealth management. With personalised strategies and innovative tools at the forefront, the future of wealth management looks not only profitable but also incredibly exciting.