Insights & Opinions

The Semantic Bank

Thu, 17 Jan 2019

Many of you know that since November I am freelancing, discovering the world of banking and banking technologies. One of the great advantages of freelancing is that you can pick the projects you like to work on.

Freelancing also generates time to think, to discover as well. Through my work of The Banking Scene, I got in touch with a small company in Brussels that developed a software solution that helps understand business what their IT system is about.

Indeed, Ontology-Centric Banking Software.

“We are selling a gigantic reduction of IT complexity and disorder. To do that were are not proposing to replace, but to make the existing transparent from a business point of view”

Yes, you are right; there are many solutions providers that promise this. Although it is a great tagline, it is not what I like most about their solution.

They built on semantics: semantics and ontologies.

In this blog, I am going to try to explain this in a way that the essence is understandable for all. Would this not be the case, or if you would like to know more about it, please leave me a reply, and I am happy to help! You also help me by the way, because your answer would mean that I need to find a better way to explain it ;).

Semantic Banking

Semantics is the study of meaning. Semantic banking is about making the banking infrastructure understandable. Semantic Technologies allow us to implement systems, to adapt business rules, to integrate services at the level of conceptual meaning, instead of the level of a structural code (which is what traditional technology relies on).

The semantic bank introduces a common language for everything, for products, processes, business units, business logic, business rules, data classification, software, IT systems.

Important: the universal language can be read and understood by the business.

In doing so, a semantic approach provides banks with a translation of IT components into something that can be understood, interpreted and managed by the business. It becomes a layer on top of the current infrastructure.

This layer is not a technical layer, but a business layer. That is what differentiates them from most other solution providers that claim the same selling propositions.

The advantages can be enormous, especially when combined with an organisational change that puts the business back in control of their business rules.

Today business orders a change, through a change request. This change will be analysed by a business analyst, followed by the functional analyst, and a developer.

In the semantic banks, this will change.

What I like most about their solution is that it provides a way to give back to business what they deserve.

The business has always been the owner of business rules. Too often though, most of this ownership is outsourced to IT. Business says IT what they need, in words, and IT needs to figure out how to make it happen, in code. This worked for a long time.

Today, things are changing. Things change fast! The continuous change forced banks to rethink the way they adapt to change. The agile methodology is one of those answers. Agile works in many organisations; however, in many others, this is reaching its limits.

These days, every business change becomes technical, and this puts too much pressure on IT. Not only are they always blamed when things go wrong, they simply have too much work. This result in an unbalance of ownership and responsibilities within the bank.

To understand how it is important to know what Ontologic banking is all about.

Ontology-centric banking?

Indeed, Ontology-centric Banking.

Ontology, a matter to finding common understanding, both in concepts, relations as well as rules! It is a domain model that can be characterised by the following three elements:

- Formal: it is machine-readable

- Explicit: it is a sum of units, entities, and how they relate to each other

- Shared: it is in a consensus, with agreed vocabulary (such as a standard called FIBO)

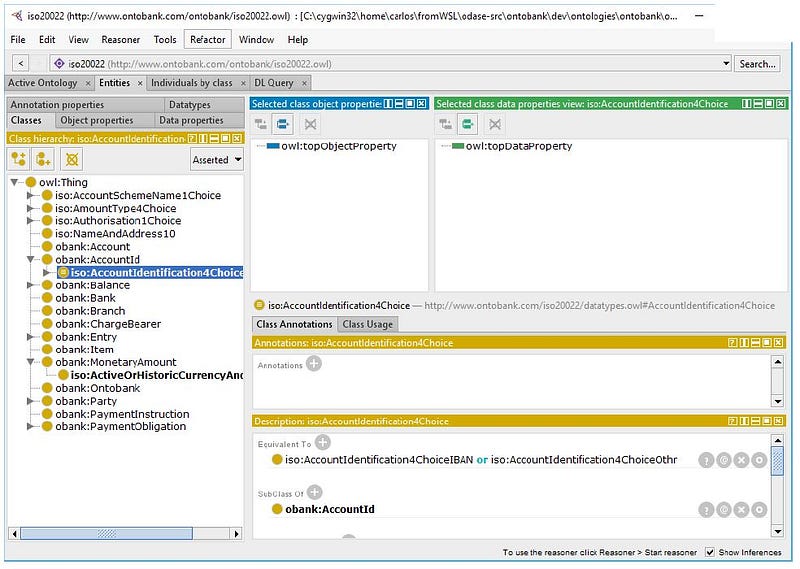

The semantic bank introduces a new role: the ontologist. An ontologist is a new generation business analyst. His role is to model a business program, in the language of the business as an ontology, defining the domain concepts and their relations, as well as rules.

The ontologist models this problem in partnership with business, which provides the requirements, and test data. Only after an iterative process of testing, explaining, improving, testing… the ontology goes to IT to add a technical code to complete the functionality to create a fully working API.

This approach results in a common understanding of the information system for both human and machine.

You can compare it with SQL vs more modern reporting tools like BusinessObjects: SQL provide the technical background, and BusinessObjects give the business the right tools for their own reporting needs. BusinessObjects makes the life of IT easier: business can create its own reports, so IT can do what they are good at managing the infrastructure.

This is similar to the semantic bank. It means that there is an environment, at a business level, where they deal with business rules. With the right setup, a bank could even have a test environment, where change requests can be tested, evaluated and modelled in real-time, in the language that can be interpreted by the business.

Key advantages:

- Speed: shorter sprints to achieve concrete and tested models before the intervention of IT

- Increase in productivity: lower lead times, and less work for IT

- Agility with quality: models are tested before any action of IT is required

- Transparency and auditability: everything is documented in an understandable language

Ontology-centric banking is most of the time about better data management. So for the ones who are (more) familiar with ontology, and with what ontology-centric banking stands for today, can see that this solution is going further than the regular use cases.

Ontobank (this is how they call their Semantic Banking platform) wants to transform the way you manage your complete banking infrastructure, or part of it, if you like, so not only massive data silo’s but the entire system, if you wish.

They can also simply start with only a small part. The solution is highly flexible, and translation into ontologies can happen on any scale, even as the scope remains meaningful.

What is also great about their solutions is that it does not try to transform the underlying infrastructure into something more modern and flexible. Still, they provide a business layer on top of the existing infrastructure.

Ontobank does not want to make a lasagne of the spaghetti that you banking infrastructure is, they simply want to provide you a fork and a spoon to make the spaghetti manageable.

A few references

One of their references is Aviva, a French insurance company.

They needed a solution to act faster on the prices of the products. Before implementing the Ontology solution, changes were only possible every quarter. Thanks to the Ontology-centric approach, Aviva can change their products, bundles, and prices daily, AND at a minimal cost.

Not only is business in control of their business rules, but they also have an immediate impact on their business rules in production, without the intervention of the technical IT guys.

Another is the Ministry of Defence of France.

The Ontology-Centric approach is not only used for development but also integration. For the French Army, it was used for semantic integration between Payroll and Pensions, and between French and NATO Command and Control systems.

This shows the considerable potential of their product. Now they are looking for banks eager to collaborate to proof the value they can bring of the banking industry.

Would you have anything to add on this, or if you would like to know more about it, please let me know.