Insights & Opinions

SME Banking Will Never Be the Same Again

Mon, 11 May 2020

The new battlefield for challenger banks and fintech is the SME market, and COVID will not stop that process. The Banking Scene Afterwork of May 7 was about precisely that, with our special guest Brad van Leeuwen.

SME financial services is a complicated business. If you know that 99% of all businesses in Europe fall under the definition of an SME, you get an idea of how diverse the market looks. A construction company with 20 workers, a 100-person professional services company operating in different countries, a small shop owner or a freelancer have entirely different needs. They have different interests. They have separate identities.

Because of their great variety, you cannot serve them all the same way, even though for decades, that is what banks did.

Together with a crowd of 25 professionals from all over the world, we looked at the past, the present and future of SME banking to find an answer on how the future of SME banking may look like.

Moving away from the one-size-fits-all model

Like I said: SMEs is a very diverse market segment. ‘Segment’ is not even the right word, since it is a multitude of different personas. I know this is not a revolutionary new insight.

One of Brad’s conclusions from the many adventures in SME banking is that it is impossible to service the biggest enterprises the same way as the tiny ones.

To make his point, he took the analogy with CRM tools. Companies traditionally built CRM tools in-house. Only the biggest, most sophisticated players in the world could afford to develop it. The first providers of external CRM software, the ones that made the market, set up one-size-fits-all models, which worked for some time and some clients.

Cloud computing provided a lower threshold for CRM solutions at a much lower price. Today there are hundreds of CRM systems that benefit from the low cost of developing software, and they attack niches in the market. They may not be reaching the big scale that companies like Salesforce have, but they are incredibly relevant, and solution-driven for their target group.

Why would that be different in the banking industry? Microservices in the cloud made banking systems much more flexible, with shorter development times, and quicker processes to fulfil their customers’ specific needs.

Yesterday, customers were served with THE business bank account, and today you start to see niche products, all tailored for specific personas and user journeys.

Who cares about digital banking today?

Coming back to today’s essence of financial services: the least of SME’s concerns is perhaps digital banking. It is liquidity; it is survival. Banks have a societal role to play.

Eric Van den Bergh: “Today banks shouldn’t talk about innovation or digitalisation for SMEs. It is not what they are thinking about today. Let us hope it is only for a short period, but today this is reality.”

To make it more concrete: in Belgium, 116.000 professionals and business were granted a delay on their credits, and in the Netherlands, this was 111.000 cases.

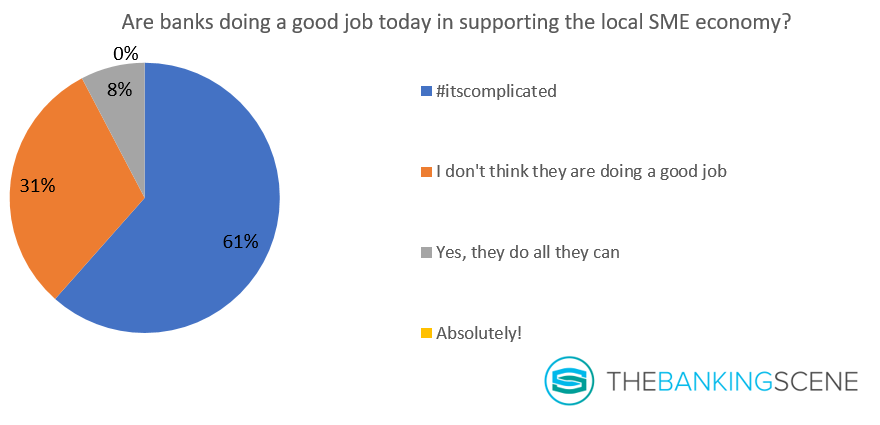

Question is: are banks good in dealing with the current situation? Are they a good partner for their SME customers in bad times? Here you have the opinion of our audience:

It is complicated. Indeed, we cannot blame banks for being cautious; they are not the lender of the last resort. What is true is that in situations like today, the shortcoming in processes, in infrastructure, in credit scoring suddenly become very visible.

Most banks need to figure out how to solve this, at scale and in a very short time, when businesses, their customers depend on their banks’ agility to survive. Even the best of the more traditional banks struggle. The massive amount of demands is hard to deal with, but it shouldn’t be hard. If it is just the processing of loan applications, it should not be a human bottleneck problem. It should be a technology and processing problem, which is easy to scale up.

Credit scoring in today’s new reality is another concern. Luc Gillain referred to the case of Maxi Toys, a toy chain with 200 retail shops and an e-commerce store. The company has 0 credit history, simply because they were a good company in a normal market situation. With COVID, they faced liquidity problems. To solve that, for the first time, they approached banks for a loan of 30 million.

Not one bank was willing to help: their priorities were existing customers, and because there is no credit history, not in France, nor Belgium, banks found it difficult to calculate the credit risk they face with Maxi Toys. This clearly shows that the process of credit scoring deserves a serious revision in many institutions.

Andrew Vorster referred to a UK Facebook group for small business in the UK to help each other with navigating the complicated process off applying for business interruption loans, the grants from the government and all that.

Andrew: “I have not seen the legacy banks going “Don’t worry, you’ve been trusting us, we’re gonna trust you. There is 0 trust. There is nothing. There are their rules, there are liquidity rules, there are affordability rules, and even for the government-backed loans, I just don’t see the banks sticking up at this moment.”

The answer of challenger banks to COVID

What pushed the first challenger retail banks is equally true for the SME segment: many are built on the personal needs of the founders, needs that were not fulfilled by his own bank. The purpose of building the bank becomes personal, which makes the business model, the personality and corporate identity of the bank much stronger.

How do these challenger banks deal with struggling SMEs? Tide bank and Starling seem to be able to provide the right service, with money from government-backed loans on the account in a few hours. They did find a way to adapt their processes, including measures to detect scams. They are capable of doing what many incumbents are not.

Marijke Koninckx explained that Tide has a lot more data points to make better-informed credit scores. Tide integrated accounting tools, which grants them access to a lot more data than simple transaction lines like their customer’s details on payrolls and receivables of that business.

SMEs understand now that providing Tide access to all these details is mutually beneficial: it provides a more accurate credit scoring, in a much faster way. This and the lack of legacy thinking (incumbent’s bad experiences with the regulator) is today changing the market in favour of these new players in some markets.

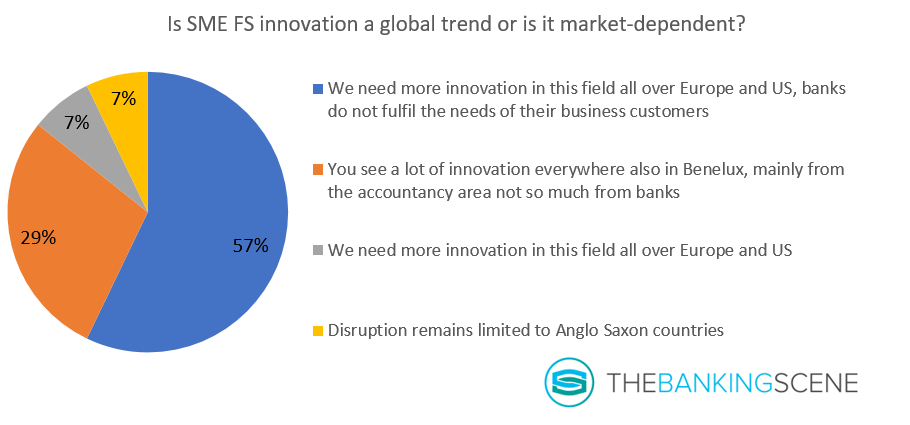

Is SME financial services innovation a global trend, of market dependent? This is what the audience thought about it:

“Whether we like it or not, it’s going to be global because of regulatory arbitrage”. With the SME neobank Neat as an example, Brad shows how this market is currently going global. David Rosa, the Founder and CEO, figured out that with his Hong Kong banking license, he may not market to Belgian companies, but with the right KYC logs, he can onboard them. Thanks to the internet, customers come to them.

In the digital world, it is easy to connect to all kinds of global platforms and payment systems. So suddenly the market of a Hong Kong licensed company is no longer limited to Hong Kong, but the whole world is open to them, from the poorest African country up to Belgium and the United States. The services cover the more straightforward products like payments, account services, remittance and issuing, spend management. Soon it will be lending as well.

Banks will be experiencing, also in the SME segment, more asymmetric competition. Fintechs started eating the easy wins first, within the same regulatory environment. There is no direct competition because these fintechs only provide a niche set of services.

More ambitious parties like Neat will now start competing even more asymmetrical.

A new generation of SMEs will rise from the ashes

A higher than average percentage of SMEs will fail in the aftermath of COVID. But the needs, the purpose of those businesses will remain: hairdressers, bars, restaurants, local stores, will remain relevant. So other entrepreneurs will stand up and fill those gaps in the market.

These other, new entrepreneurs will have different expectations and other ways of dealing with business. That is equally so for the relationship they have with their financial institution.

How will this new group look like? First of all: they will probably be much younger. These younger entrepreneurs will not be looking for bank branches anymore. They want their financial services to be seamlessly integrated into their business digitally.

These new entrepreneurs only know digital banking and they expect the same in their professional life, with banking products within seconds on their phone. They expect technology to do things for them, in a superior UX.

If the banks return sufficient value to the customer, these customers may be willing to share more insights. That makes me think back to a conversation I had with a banker that was specialised in agriculture. They are thinking of using PSD2 to provide government support faster through loans, by asking their customers more data for more accurate credit scoring.

This kind of services is what the new generation will be looking for: what value will the bank bring me?

How should the future SME bank look like?

Another meaningful change is the way customers look for solutions to their problems. The new generation will not first talk to their banker; they go to Google, Whatsapp, Facebook… Customers no longer go to where the products are. The key concern of distribution in the future is: how will banks be able to provide their products where the people are?

Highstreet banks are banks that used to have their office in the streets where the people were. Over the years, this changed with the internet. Look at where people spend their time on a smartphone and ask yourself: how can we offer our products on this new digital high street? That digital high street is not the bank’s mobile app.

The new generation will look for embedded banking experiences (Karin Van Hoecke called it ‘the ultimate laziness’ that banks should aim for in her Open Banking Interview). SME banking will no longer happen in a bank app, they will look for it in all kind of platforms that have financial services integrated into their model.

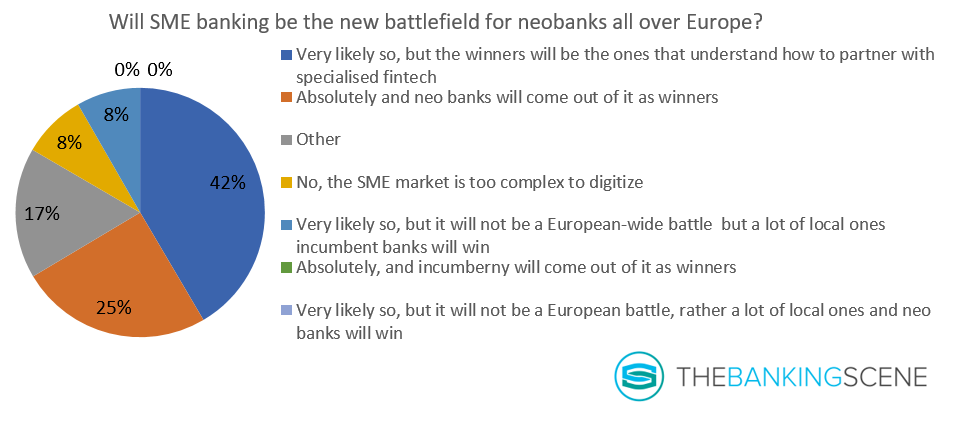

The partnership model will become increasingly more important, which was confirmed by 42% of the audience affirming this in the last poll.

Message to the banks: get banking out of the banking app and bring it to all kind of platforms. That is accountancy, HR, all types of customer journeys of SMEs. Bank products will continue to fragment, just like CRM systems see (see also my blog on niche banks). Banks will need to find out what role they will play in that new world. How many niches do they want to serve? How many are they able to serve? What is the bank’s purpose, for which clients?

Brad: “Banking is going to be a step in a user journey. Today this is in a seamless payment in Uber, tomorrow it will be in the recruitment process perhaps, it will in the onboarding process of a new supplier, when you want to manage your cashflow. This will no longer be something you discuss with your bank, it will just happen.”

Looking at the bigger picture, beyond where to offer financial products, the real purpose of the bank may not change. Banks as financial trainers and advisors is not new, the mindset from selling products to improve the bank’s results to selling products to enhance the customers’ results is for a lot of institutions very new.

By improving the trust of the community, the P&L of the bank will organically enhance as well, without the need to set hard sales targets that are only beneficial for the bank.

If you like to read more about this topic, please have a look at following more recent post: The Banking Scene - Why do SME need extra funds and why should your bank manage such applications?