Insights & Opinions

How a virus changed the relationship between fintechs and banks

Mon, 18 May 2020

COVID-19 has a tremendous impact on many fintech companies, for good and for bad. The shift to digital is undeniable, and banks understand this as well. At the same time, however, they have become more selective in their investments and partnerships. Fintechs that are low on cash may be struggling now. This will impact the negotiation power of these young companies.

How is this impacting the fintech industry? How can banks benefit from this situation?

To answer that question, we asked Don Ginsel (CEO Holland Fintech) and Toon Vanagt (Director Fintech Belgium) to join us on May 14. For the first time, we invited two special guests. The result was a session with more input from the experts, spiced with some exciting poll results to feed the discussion. As always: a big thanks to these two special guests and the participants. This blog would not have been possible without you!

We started the session with a first poll, to capture everyone’s opinion on a first dilemma: “how will this crisis turn out for fintech?”. The vast majority believed that collaboration is the right way forward.

I know, and the discussion afterwards confirmed it: the answer looks different depending at what kind of fintech you look at.

“The good times are over, make sure you make revenues now.”

Smaller size today is an asset. It means there is a lower cost to sustain and more flexibility, making it easier to adapt to change.

Toon’s experience as an entrepreneur in the dotcom crisis comes in handy here. Today, all that matters is changing to the circumstances. He quoted Sequoia: “The good times are over, make sure you make revenues now. The catching eyeball and high acquisition costs are things from the past. Now you need to show you can be profitable very quickly and that you can survive with the money that we’ve been giving you so far”.

Don: “Everyone that has a hobby, is probably able to sustain it. If you don’t have active customers, then it is a hobby.” And we all know that usually, you don’t earn big money with a hobby.

Stop the bullshit bingo: if you have a model that is simply based on hot topics, without a sustainable revenue source, you will not survive. We see that with small players, but also with the big ones. The key metrics today need to demonstrate a financial and sustainable future for the organisation.

Here lays the difference between an Adyen and Monese. Monese has planned closures of offices in Berlin and Lisbon, and the possibility of 40% of employees to be affected by reorganisations, where Adyen is worth more today than ABN Amro and ING together.

Less then two years ago, the company went public at a price of 240€/share, today that rate is 1.000€, in the middle of a crisis! With a profit in 2019 of almost €500 million, they demonstrate resilience and a future-proof business model. They can be trusted.

Truth be told: convincing investors with hollow statistics is over for quite a while now, long before the COVID-19 crisis. For the last year, fewer fintechs were founded, and new investments were distributed in a more consolidated way.

Don does not believe that COVID-19 will suddenly transform the Fintech industry; it will merely result in an acceleration of trends that were happening already. What we will see according to him is:

- Lower growth of new Fintech companies in the coming months or years

- Smaller players that do not have a waterproof business model will leave the market faster.

Sounds familiar? If you read my blogs, you may have read this before in the interview with Richard Turrin, on March 23, 2020.

In stressful times, people and organisations go back to what they know.

We live in uncertain times and in stressful times.

In stressful times, people and organisations go back to what they know. Their risk appetite goes down. The well-known fintech brands and the more mature players have a substantial competitive advantage here. Especially the supporting B2B fintechs in the bank platform business, AML and other compliance-related topics are currently skyrocketing.

If you have a network, now is the right time. People fall back on trusted people, trusted organisations, a trusted network.

On the losing side of the spectrum are the ‘nice-to-have’ services and new initiatives with a team without an existing network in the banking industry.

Remote working has not only changed the way we work, but it also changed the way we network. All kind of procedures and routines help in the way you work from home, but how do you network from home? How do you deal with this, after years of making new contacts at trade fairs and network events?

How do you negotiate through a screen with multiple small screens, each with another person? How do you keep focus? Reading the room is tough these days, and tiring. But it is vital in negotiations.

The biggest threat for one is an opportunity for another.

We live in uncertain times. Although we don’t know for sure what’s coming, a good estimation will make us better prepared for the future, as we learned a few weeks ago.

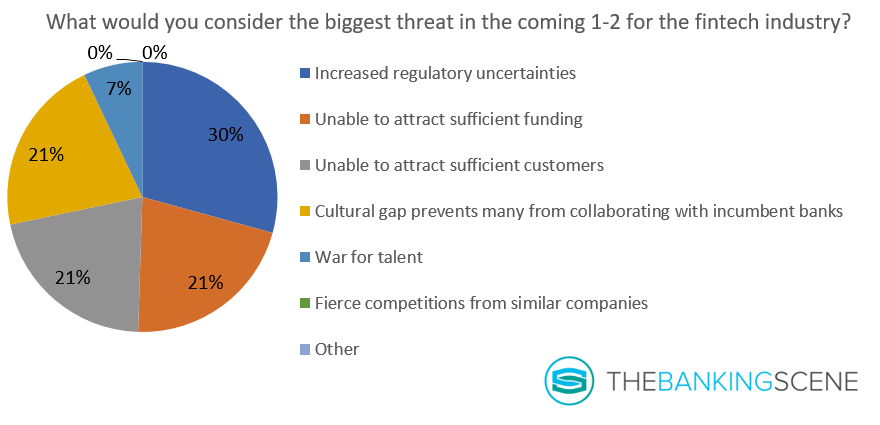

The biggest threat for one could be a considerable potential of another, especially in negotiating a partnership. So, we asked the audience what they think is the critical threat for fintechs in the coming 1–2 years. The result was a very balanced pie chart, probably because one answer will automatically influence the others, you cannot look at them separately.

Toon: “If you attract customers with the right value proposition, you will keep attracting funding as well. These companies will stay relevant. A profitable product that you can sell is the basic recipe for success, also in a crisis.”

The number one answer was the increased uncertainty coming from regulation. Regulation and compliance determine the investment budgets for years now in the banking industry. Although the trust that these regulations generate in the long run is a good thing, the framework isn’t stable yet. The regulator keeps pushing new rules and directives, and there is no light at the end of the tunnel. There is a lack of trust in the meantime.

Regtech companies see this as a blessing, but most fintechs have a hard time, sailing their ship in the dark because of this lack of transparency. Collaboration with banks could help. They know how to deal with regulation. A partnership could make sense, but mind to dependency on one supplier.

Toon: “As an entrepreneur, I am always very cautious about building my business on a third-party platform. They might, from one day to the other, change the terms and conditions and make you even more dependent on them until they completely squeeze you out and your whole business is gone.”

How all this changes the fintech-bank relationship

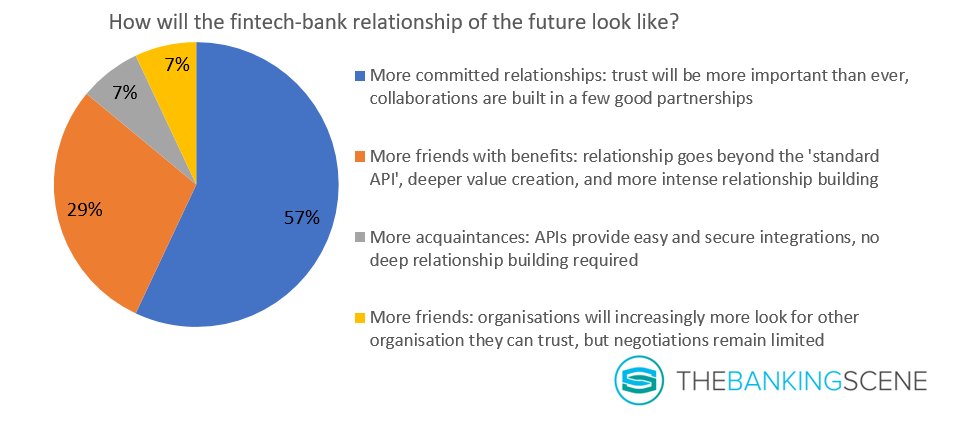

Coming back to the topic of the day: how does all this impact the fintech-bank relationship? I wrote about the different kinds of relationships before, about a year ago. That is where I got the inspiration from for the last poll. We asked the audience: how will the future relationship between banks and fintech look?

The industry, or at least the conversation around the industry, was characterised by superficial relationships between banks and fintech. Rise of Open Banking created an environment where trust was becoming increasingly more programmed. Integrating services was straightforward: “Connect to our API”, “Test the connection in our sandbox”. Relationships were no longer supposed to require lengthy negotiations and huge contracts. Relationships were supposed to be open.

The question is whether the trends will continue during COVID-19. The poll in our session indicates a change. Trust will become more relevant again. With trust, we mean human trust and relationship building, knowing each other and making sure you can build on each other to become better altogether. 57% believed that collaborations would be built on a few good relationships.

As Don explained: “Until five years ago, banks wanted to own everything they worked with, a full control. Very slowly, we start to get that is not the best strategy. By owning something, it is tough, and very expensive, to replace it. Gradually the bank began to realise that they want to use solutions that support their business; they don’t have to own them. It allows them to change lanes.

Banks are at the top of the value chain and become the orchestrator of that value chain as you see in automotive. Most of the big brands don’t produce that much themselves. They simply orchestrate all their suppliers to make sure that the cars roll out of the factory seamlessly and that they get distributed.

The same could apply for financial institutions. We have 6000 banks in Europe, and it doesn’t make any sense to keep all of them alive, it is not efficient. They cannot all be the best asset managers and the best payment providers and the investment advisors.”

Where we started to see more relaxed, loose API-based relationships happened, with COVID-19 that is less the case.

Today people are going back to their old reflexes. Today they go back to the companies close to them, it takes longer to have a relationship, and they require more effort in trust between the involved organisations.

Once in a relationship, Don believes that banks will require more control to make the relationship a success. That will make them the orchestrator of the supply chain in the future.