Insights & Opinions

By Improving Financial Wellbeing, Banks Become Health Companies

Tue, 02 Jun 2020

A bank must support its customers in having a financially balanced life, helping them to reduce financial stress by improving their financial wellbeing. It is one of its societal responsibilities. Many studies show that it is impossible to separate stress and financial stress. People that feel stressed are also worried about their financial situation. There is always a correlation between both.

Last week, we talked about that topic with Menno van Leeuwen, Head of Lower Financial Stress at Moneyou during The Banking Scene Afterwork.

Financial wellbeing is not just a problem of the young

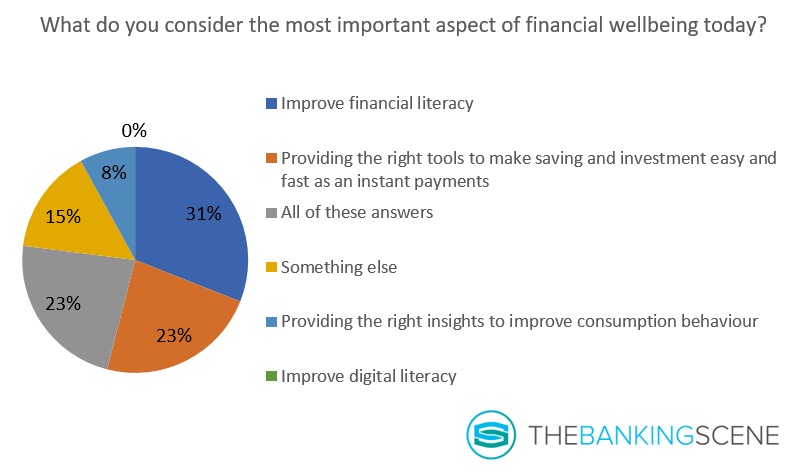

Banks have many ways to improve the financial wellbeing of their customers. Top-of-mind, financial literacy comes first, followed by providing the right digital tools to help consumer save, invest and spend better.

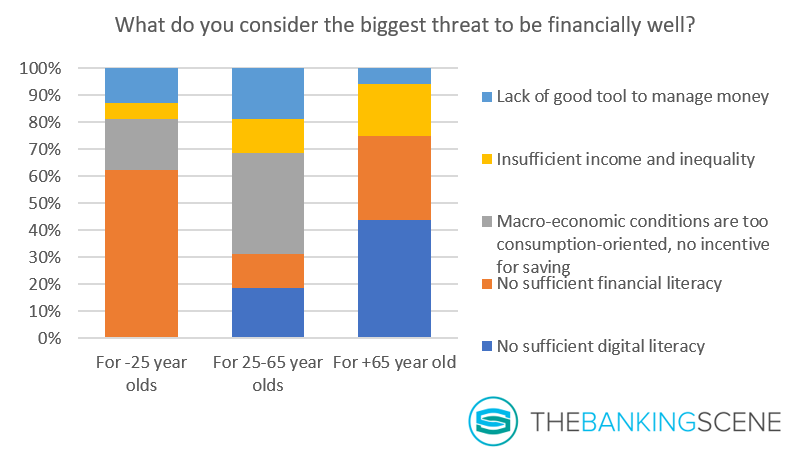

The feedback is more nuanced when putting an age on the consumer’s head. Suddenly financial wellbeing requires a different treatment depending on the generation. This is what the audience thought:

The differences are striking: the older the consumer, the more digital literacy is the problem, whereas youngsters’ key concern is financial literacy. Macro-economic conditions only play a dominant role for 25–65 year-olds, according to the audience.

How to measure financial stress?

To measure is to know. The capacity to measure facilitates the search for a solution and the evaluation of the suggested solution. But how do you measure financial stress?

Given the correlation between stress and financial stress, banks should simply focus on lowering the stress of their customers as a KPI to evaluate how well their tools help in lowering financial stress.

Looking at the bigger picture, banks are not just financial doctors. Given the correlation, a bank should not only position itself as a financial services company but also as a health company.

4 axes determine financial wellbeing

4 important dimensions, altogether, determine a consumer’s financial wellbeing. Menno believes that banks should proactively build value propositions on these dimensions, that way reducing their customers’ financial stress.

Know yourself

Self-knowledge is the first step to financial freedom.

How (much) do you spend? What are your dreams and aspirations? What are your savings goals?

Know yourself and let banks help you with this. Let them mine and nurture all the data they have on you. Let them transpose these data to concrete insights. Thanks to European regulations like PSD2, personal finance management (PFM) has become a battlefield to attract new customers.

Banks and fintech that provide the ultimate PFM will win this battle. They are equipped to help understand

- what you consume,

- how you consume

- how to consume better to reduce financial stress?

Know yourself implies that you should understand which services you need and which ones to avoid. Before the internet, everyone watched TV, everyone listened to the radio and so evaluating bank commercials was a family thing. This already created some financial literacy, from parent to child.

Today, media consumption is fragmented, making young people vulnerable to unnecessary promotions and increased risks for unnecessary purchases of financial products.

Know your financials

Menno believes that to be financially well, you need to understand your financial situation, your financial behaviour and how your money is managed. Too often, banks facilitate this in a very linear manner. They provide a bunch of paper with the information on the products you buy, the decisions you make, and the risks attached to those decisions.

The idea is that you almost needed to be educated like you were a banking advisor. Used to be…

Today, banks should augment financial knowledge by making financial products simpler and much easier to understand. Better design of services, easy to use tools that make it easier for customers to decide a well-informed way, solutions with integrated gamification opportunities should make financial education fun and engaging.

Digital and AI capabilities can help banks in guiding customers to a financially fitter life, by asking the right questions.

What is the first thing you do with a fitness subscription? Exactly: you answer a list of questions. These answers will help the personal coach to understand what your ambitions are. Based on that they will provide a suitable plan. Why should this be different for financial services?

MiFID forces banks to do this for investment products, extend this to all banking products: from investments and lending products to payments and credit cards. The insights will help banks to provide the right context, the right services and a tailored product offering to make the life of a customer easier.

Know your relationship with money

For so long, money was physical, it was tangible, and it was easy to split up your spare money in different… let’s call it mental accounts. People would put aside cash for food, cash for clothes, etc…

Over the years, the bigger spending, like utilities, rent… were automated by electronic credit transfers and direct debits for example.

Recently (over the last 10 years) cards took over from cash for the smaller amounts. Payments evolved increasingly more to frictionless and the pain of paying disappeared. All this made money intangible, and harder to manage, especially for the generation that grew up with cash and need to adapt to digital.

How do you relate to money?

As we move more to digital, so does our relationship with money. For a younger generation, cash is increasingly more interpreted as intangible, something you cannot manage digitally. They start to interpret cash as “an extra”.

Know your financial advisor

Sharing problems provides instant relief. People in a precarious situation should be able to speak to others about their problems. Talking about money and your financial situation is a taboo.

People don’t easily turn to their friends to talk about their financial problems. Social sharing: yes, financial sharing: oh no!

Branches close and the constant reorganisations reshuffle the employees at such a pace that there is no time to build a trusted personal relationship anymore. You used to trust your banking advisor for your financial stress and problems. But where are they today?

Chatbots could be a cost-effective solution to compensate for this loss of a trust branch clerk, on the condition that the service feels sufficiently human. If people don’t feel like the machine is truly ‘listening’ to them, they will quickly ‘unengage’.

Some examples of how banks contribute today

Founded in 2018, Discovery Bank is a challenger from South Africa, set up with one mission: making consumers financially fitter.

They put all their clients on a ladder of financial wellbeing. Being a house owner, for example, puts you higher on the ladder. An active lifestyle, through sports or fitness, puts you higher on the ranking. Mens sana in copore sano.

Closer to home, Moneyou invested a lot in the transparency of a consumer’s spending. An example is the possibility to split your account into different wallets, different mental accounts. You can give them a different name, visualise them with a personalised photo, swipe cards to those wallets…

Suddenly your card limit is linked to the wallet and not to the account, which makes digital payments are a lot more tangible again. Regular questionnaires and customer surveys help them to optimise their offering and to evaluate their success in reducing the financial stress of their customers.

Banks have the social responsibility to take

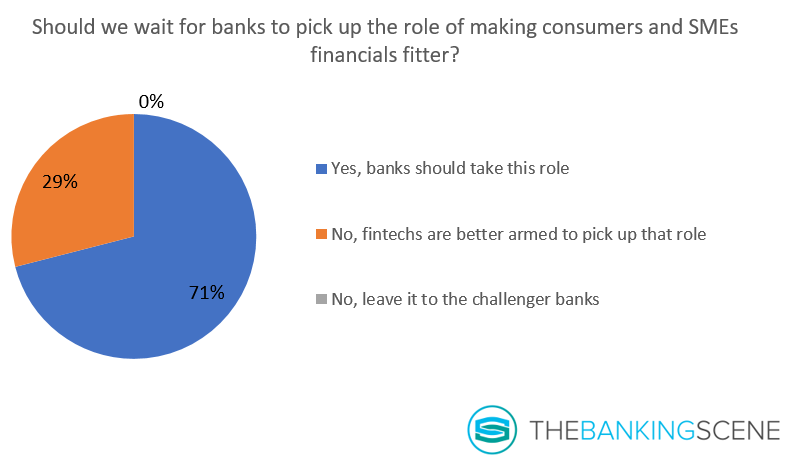

Society expects from banks to help consumers being less financially stressed. The audience of our last poll was clear: 71% believes banks should take the initiative.

Sometimes fintechs are better equipped with tools to help consumers. They are more creative; they have the agility to act fast to adapt to new societal shifts, but banks have the masses in their client portfolio. By working together, they can make a difference. Technology trends like open banking will stimulate this more than ever.

Fintech and banks should work together in partnership for a brighter future, for a financially healthier society. Don’t forget: by improving your customer’s wellbeing, you are not just a financial doctor, you are also the ‘apple that keeps the doctor away’.

As Menno said: in a way bank that work on lower financial stress is not just financial companies, but also health companies.