Insights & Opinions

Building Resilient Organisations with Foresight and Horizon Scanning

Mon, 04 May 2020

I gave myself the challenge to moderate a session last week (April 30) at The Banking Scene Afterwork on “The Meaning of Foresight and Horizon Scanning”, for which I invited Christophe Kempkes, Partner at Fingerspitzen Kollektiv.

Half a year ago, I virtually met Christophe, and we talked about the future and about the societal changes we were witnessing. The last significant societal change was a real shock, Covid-19. Christophe warned me for the impact long before I understood its reach.

With Covid-19 all over the news, it struck me how some people and organisations seemed a lot better prepared than others. It made me wonder: what is foresight essentially? What is the difference with horizon scanning? Should we invest time and energy in foresight, as a person and as an industry?

In all honesty, it took me some time to understand the first principles of foresight. Even, while writing this article, it occurred to me how little I knew/know about it.

What is foresight? The short version

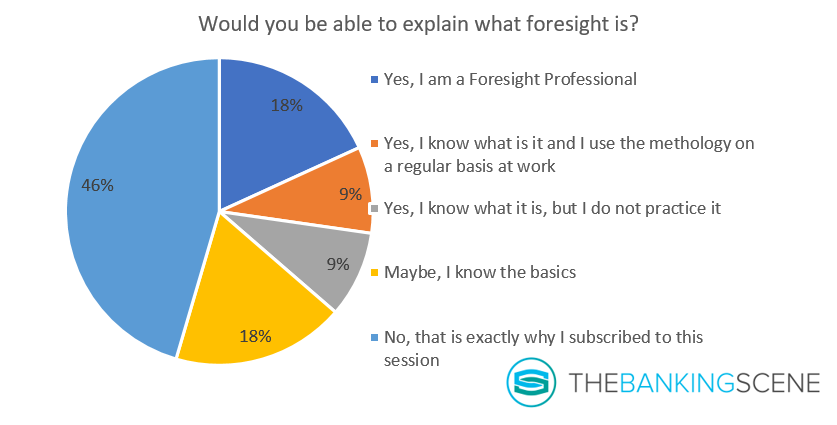

Foresight is a relatively unknown concept, also for our Afterwork audience: we asked them if they would be able to explain foresight. 45% answered they are unable to explain it.

Foresight explores possible futures in a systemic way to make organisations more resilient and better prepared for the future than today. It is a powerful strategic tool to manage uncertainties and to explore systemic innovation for new product development.

Notable in this definition is:

· foresight is not a prediction

· foresight explores multiple possible futures; it does not end up in a single truth

· It is an ongoing systemic process

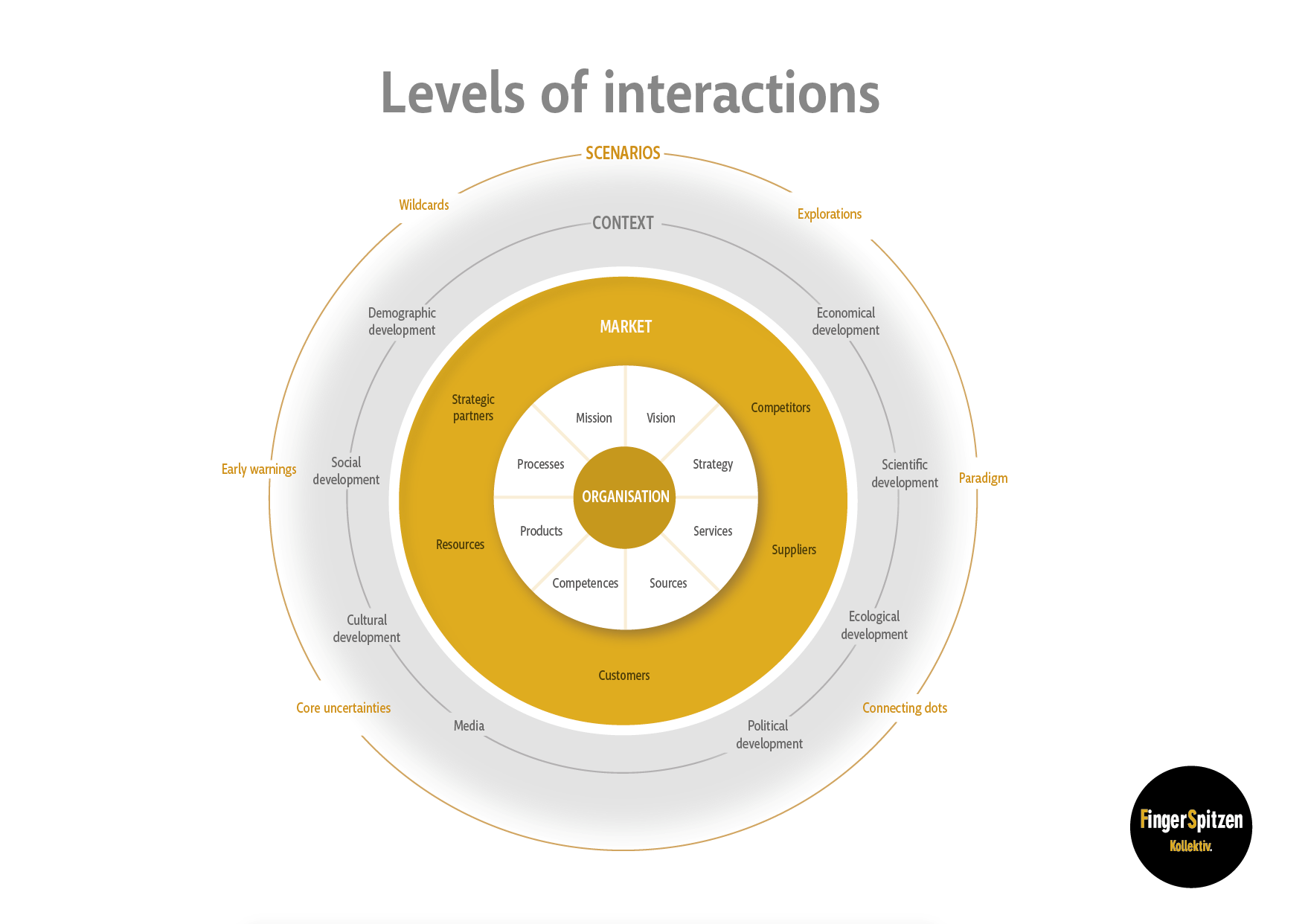

Essentially we can detect four levels in the foresight process, which are nicely illustrated by Fingerspitzen Kollektiv in the image below.

STEP 1: Know your organisation

Every discovery starts with a self-scan. “Know yourself before you try to deal with a relationship”, they say. That is not any different in this context. Who are you? How are you organised?

Get all the data together to know your customers, suppliers, internal processes, products, your competitors, strategic partners? What are the regulatory constraints and opportunities? What is your vision, your purpose? What is your organisational culture, your corporate DNA? Do you want to have an impact, and how would that look? Once you know yourself, you can start looking beyond yourself.

Most organisations have this documented systemically, at least most of it.

STEP 2: Hunt for context

Hunt for context and scan the horizon. Get out of your bubble and start exploring. What is going on around you? What is the context you work in? How does your organisation relate to your environment? What are the contextual shifts we are facing, as an organisation, as an industry, as a society?

Looking for context goes way beyond looking at what start-ups are developing within your sector. Health, income inequality, tax shifts, ecology can be as essential to creating a useful context.

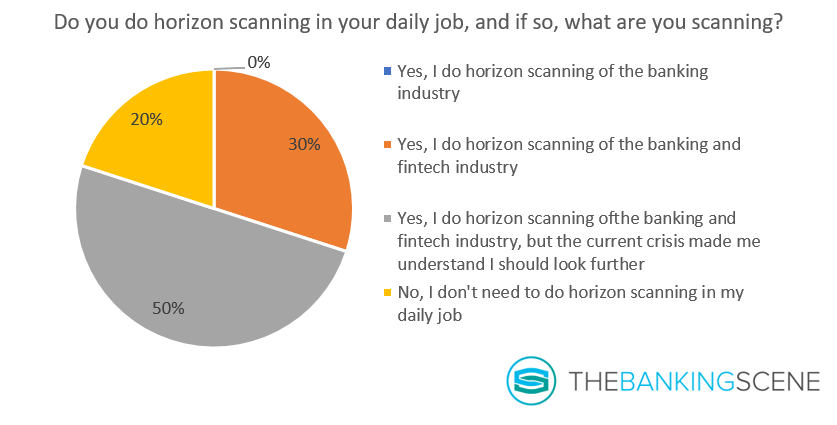

When asking the audience how far they go in horizon scanning, it was interesting to see that Covid-19 made people also realise that they should look further than their industry. Simply looking at what other banks and fintech are innovating is not enough to be sufficiently resilient in case of a big shock.

We tend to forget quickly. Looking back to 2008, in the heat of the financial crisis, we already learned a similar lesson: know the context in which you work.

Setting up the right processes in a systemic way will help you and your organisation to come up with additional objective output. By creating a structured process with horizon scanning over multiple sources, that are well-validated and checked, you can make a more personal horizon scanning a lot more objective and representative for the whole organisation. A mix of field research and desk research, both internally and outside to the organisation is a necessity in creating this more objective horizon scanning.

Hunting for context creates a complete vision and idea about where your industry and society may be evolving to and what your organisation could mean in that context.

STEP 3: Sift your key uncertainties

We know the context now; we created a picture of what is going on around us. Or let’s compare it to a movie: it is not a snapshot; it is a continuous process. Out of all that documented material (so-called driving forces on a macro, meso and micro level), it is now time to filter your key uncertainties. Key uncertainties are highly uncertain events, with a potentially significant impact, according to the determined time horizon. These key uncertainties are the building blocks of a matrix from which we build possible future scenarios.

A few examples are (a)the possible shift from globalisation to regionalisation, (b) Bigtech will apply for a banking license and enter into direct competition with retail banking, © a mentality change of consumers accelerates demand for digital services, or (d) Central Banks commercialise the Central Bank Digital Currency and enter in some domains in direct competition with banks.

Have a team of key people within the organisation to do this sifting. This will not only create the necessary buy-in, but it will also make the result more balanced and more objective.

In foresight, you look for the different unknowns. The complexity is that various forces may also reinforce their impact and outcome. We don’t know which combinations will appear. That is why in foresight you have different futures. Mapping the key uncertainties will grow an organisation’s long-term robustness.

STEP 4: Internalise key uncertainties back to your organisation

The key uncertainties are now matched with the corporate strategy, resulting in an action plan that anticipates on these key uncertainties. This step will make your organisation more resilient.

The pandemic was on the risk management radar for many years in the financial sector. It boosted the robustness of the industry; they were aware of this possible event to happen. Probably this was merely the result of guidelines from international institutions, and not so much an outcome of a systemic foresight.

That next step: the setup of a systemic foresight process, including the creation of a proper action plan, will make the organisation also resilient: it can adapt in these exceptional circumstances.

A positive exception in the context of Covid-19 in Belgium was BNP Paribas Fortis. They internalised the key uncertainty of a pandemic in their organisation. They were so well-prepared that they could already donate 125.000 face masks to hospitals from the stock they bought years ago.

That is, high-level, what foresight is about.

Is foresight more important today?

In today’s context, foresight seems to be a lot more relevant than ever. The world we are currently living feels like a world of uncertainty. Many like to go back to normal, but every new day brings new signs that there will only be a NEW normal. As a consequence, we look for a new reality; we create possible scenarios for the future.

Is that why foresight seems more relevant than it used to be?

Probably so, because, in its essence, foresight has always been essential. If governments and organisations had spent more energy on foresight, they would have been more resilient; we could have been better prepared for a pandemic: we knew it was coming one day.

Sometimes we need a very abrupt change to make us realise what is going on. Every crisis is preceded by signs, sometimes very small. They seem irrelevant, but they are extremely relevant, we simply don’t realise it. With foresight, these signals could have been detected a lot sooner. Your key uncertainties will change the filter you use on your inputs and suddenly signals that did not seem relevant, now become extremely relevant.

Moving away from linear thinking

Personally, my main challenge in understanding foresight was to move away from this linear thinking. I have a financial background. I learned about forecasting in a linear approach. It provided easy to understand, lean assumptions that facilitate buy-in in my business cases and financial models. With numbers of the past, I made predictions for the future.

Every year we would look at what went wrong, we list it as an exception, and together with the Sales Department and Marketing, we would prepare a new, often, over-optimistic plan for the years to come. This way of working makes us underestimate the negatives and often overoptimistic over de positives.

Too many companies manage in a linear fashion. Most strategy departments predict the future with past sales and project this to the year to come; they make forecasts. Hunting for context isn’t sufficiently used today. Prepare your future not just with numbers of yesterday, and with customer behaviour of today.

People don’t like change, but we cannot avoid it, just like we cannot predict the future. By working with a systemic foresight approach in every strategy exercise, you create an environment where change is accepted, and where mapping uncertainties are appreciated, instead of hidden ‘because it kills the message you like to bring’.

Foresight provides context. It will help to be better prepared to uncertainties.

A company-wide approach

Many big financial institutions practice foresight. Unfortunately, too often, it is just one department that has the mandate to do so. It is not ingrained in the whole organisation. That is unfortunate: diverse profiles and personalities would enrich the entire process. Some people have a natural tendency to look at the big picture; others have an eye for detail on what is going on close around us. Having both profiles will make the team stronger altogether, and everyone must be aware of that. Both personalities will detect different signals, and they will also weigh these signals differently. Together you will achieve a more balanced mapping of these signals.

This brings us back again to the first session, the one of “Avoiding the missed opportunities”: “Innovation is no longer someone implementing new solutions. It is increasingly more a change manager that facilitates an organisation to improve and to anticipate a new reality. In a way, this also means that avoiding the missed opportunities is no longer a personal frustration. If innovation is properly implemented, the missed opportunities become a group thing. Organisations that have this mindset in their DNA will be the winners of tomorrow. This is valid in any industry by the way, not only the banking industry.”

By replacing the word ‘innovation’ into ‘foresight’, you get at the bigger picture that is considering all possible scenarios to make your organisation resilient, and not just you services of product development.

I think we can all agree it is impossible to be a 100% prepared for what is coming, but we can be better prepared, and that is with a holistic view on what is going on around us.

Next session is on Thursday when we will discuss “COVID Will Change SME Banking Forever with Brad van Leeuwen. More information can be found here.