Insights & Opinions

Banks Doing Digital Right: My Learnings of The Banking Scene Summer Event

Mon, 06 Jul 2020

June 25 marked the start of summer at The Banking Scene. In response to COVID-19, it was the climax in its digital offering as well. +100 executives joined in The Banking Scene Afterwork Virtual Summer Event with the following council of wise:

- Chris Skinner, an independent commentator on the financial markets and fintech through his blog thefinanser.com

- Benoit Legrand, Chief Innovation Officer at ING Group

- Karin van Hoecke, General Manager Digital Transformation at KBC Belgium

The webinar was a 1,5-hour session, covering Chris Skinner talking about his new book ‘Doing Digital — Lessons from Leader’ and a panel discussion on the topic afterwards.

Instead of writing down all the messages, I decided for this blog to simply write down the lessons I take offline of this virtual session. Call it a teaser for Chris’s book (which you can find on Amazon).

In his book, Chris talks a lot about ING, as one of the front runners in digital banking, the main reason being their early expansion of ING direct. This balanced nicely with the messages of Karin, who works at KBC. Today they lead the way in digital banking in Belgium and a couple of other countries (Ireland, Czech Republic…), a journey that started only a couple of years ago, in 2014.

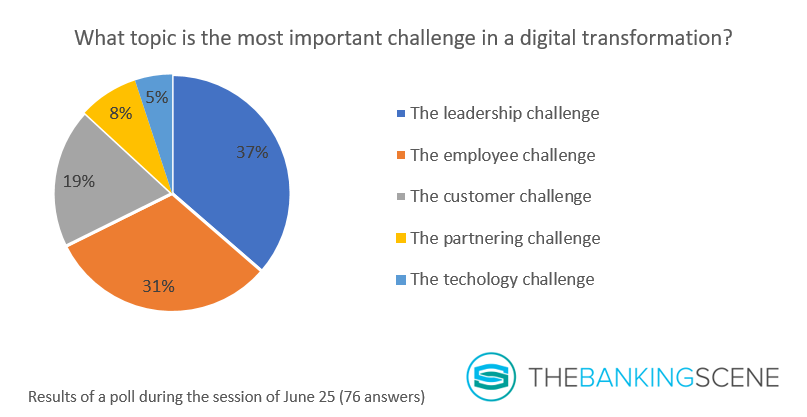

As usual, we spiced the session with a couple of polls. As the audience we much bigger than usual, the output was a lot more representative.

The most important challenge in a digital transformation

We asked, for example, what the most important challenge in digital transformation is according to the audience. We listed five challenges, which are five chapters in Chris Skinner’s book. 76 respondents shared their opinion, and the results showed that most see that internal alignment are the critical factors in digital transformation:

Leadership is clearly number one. Our experts all agreed with this.

In digital transformation, you need the right captain to sail the ship in the right direction (leadership). That captain will have to make sure every sailor is aligned to that same direction (employee).

Is that a surprise? No, of course not, everyone knows that, just like everyone knows how difficult it is to achieve.

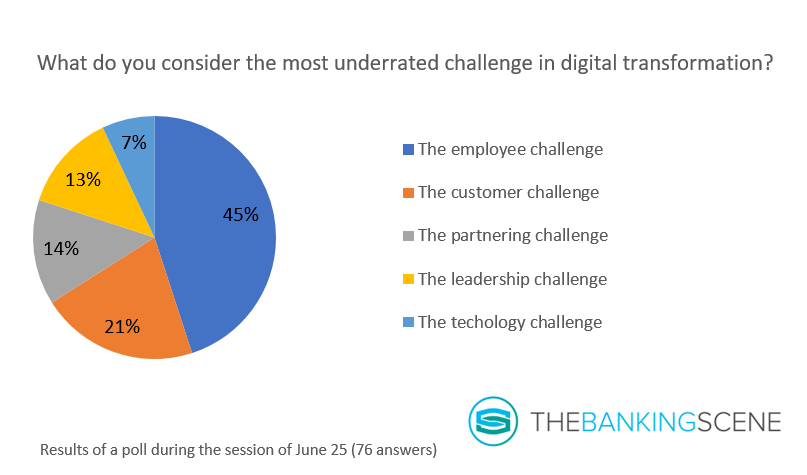

The most underrated challenge in digital transformation

In a second poll, we asked the audience what they consider the most underrated challenge in digital transformation.

The employee challenge stood out at the most underrated one, with 45% of the attendees listing this as the one that deserves more attention, with the customer challenge coming second with 21%.

Again technology can be found below on the list.

The rest of this article will dig deeper into each element with my selection of insights of the day. These insights are predominantly from Chris Skinner, Benoit Legrand and Karin Van Hoecke, for which I would like to thank them once again.

The technology challenge

What is interesting is that technology was only perceived most important in digital transformation by 5% of the audience. The partnering challenge hit 8%. In most conversations about digital transformation, people talk only about that. Today technology is engrained everywhere in the bank: in compliance, finance, product management, treasury, marketing… Technology is no longer the challenge in most cases.

This is one of the reasons why, for me, this was such an eye-opening session: digital transformation is about people.

“In technology, it is relatively easy to predict what will be successful in the future. The trick is when it will arrive.”

Take for example ING, who collaborated with British Telecom 20 years ago to provide a payment wallet to buy on e-commerce sites. The project was a complete failure because people didn’t do e-commerce back then. That is often the time it takes for technology to kick off: today everyone is developing a payment wallet, because every consumer is…. well, you know.

So yes: it is easy to talk about all the opportunities that come with new technology, but it takes vision and leadership to know when to act upon it, to understand when the technology becomes relevant for the organisation and its customers.

That requires a vision of economic and social changes, which is a lot more complicated. It forces people and organisations to think in terms of scenarios, in possible futures.

Patience is as important as speed in digital transformation: sometimes you need a sprint, but in the long run, you should make sure to keep sufficient energy to do the marathon.

As Chris said: “The financial crisis generated massive amounts of innovation and new ideas. Right now, in 2020 we are again in such a context, where the coming decade will bring lots of change and opportunities again IF you deal with it right! Rather than thinking it is a bad crisis, you should think of it as a great opportunity.”

The partnering challenge

The partnering challenge got 8% of the votes. A surprising result? Perhaps it is, depends on how you look at digital transformation. Partnering with fintech is often purely linked to a small part of banking, not so much the complete transformation, where most banks talk to big corporates, like they have been doing for many years.

The cultural differences between banks and smaller fintech players are definitely there. The question we should ask in the context of this blog is: how much are these small players contributing to the digital transformation of a bank?

COVID-19 changed the game of partnering, was we learned some weeks ago when we talked about how the virus changed the relationship between banks and fintech. Many fintech companies risk getting out of cash. These companies urgently need revenue or new capital. Banks that are ready for digital transformation should grasp that opportunity to get out of this crisis stronger than ever.

The customer challenge

A bank that is doing digital transformation well needs to be customer-obsessed. They need to know what customers expect today, and they need to know what they expect tomorrow.

Data is one of the sources to make that happen.

Benoit: “We sit on gold mines, but we just sit on it. We have been sitting on it for 30 years, and now someone is starting to dig into our mine, and we get scared. There is still a lot to be done”.

Karin: “Data was a waste for banks until some years ago. Data was a side product, and today it is suddenly air. That explains why we are so late in this.”

Data will give you what customers want, only if you are capable of managing that data properly. Just look at Amazon, without the right data mining the would stand nowhere today.

Customer behaviour is a mix of psychology and technology. Triggering customer behaviour change required the right triggers at both ends: providing good technology and making the customer understand that using that technology makes his life more comfortable. It requires the right moment as well: not too late and not too early.

Every employee in the banks should have the following question in mind: “What is the problem of the customer we are effectively solving and is the problem big enough to have him change his habits and his way of working, knowing that he doesn’t like it?”

So even when you know what customers want today and tomorrow, you may not forget that most people don’t like change. A customer may have a hidden desire for a new service, but if you don’t nurture him to adopt the new technology, all investments in that technology may be useless.

Even when you take into account all these tips, you will have a couple of failed experiments. That is what innovation brings: multiple failures and a couple of big success stories. ING invested 250 million in fintech, they have their own initiatives and a lot of horizon scanning. Reason: they don’t know what will be successful. Benoit Legrand: “We should stay humble in that.”

The employee challenge

31% of the audience believed the employee challenge is the most important challenge.

The cultural change aspect of technology is, according to Chris, the biggest challenge. This is not just Chris’ opinion. The poll on the most underrated challenge was clear on this: 45% of our audience believes the employee challenge to be the one that should get more attention in a digital transformation.

What can we learn from, for example, KBC? They started the digital transformation journey only in 2014, after recovering the financial crisis in 2009. That is no coincidence: the financial crisis changed the mentality of the KBC employees. Suddenly, they realised that it could be over from one day to another. They realised that bankers are not untouchable, and they need to keep reinventing themselves for relevance.

Good leaderships (see later)brings context, a vision and a will to succeed.

Today KBC is one of the most innovative bankers in Belgium and Europe. KBC provides more than just financial services. Parking tickets are paid automatically, public transport tickets can be bought in the bank app and in the context of open banking they look much further than traditional PSD2 use cases.

Karin observes the speed of change as the most significant challenge internally as the biggest hurdle to stay on top of the list of most innovative banks. How do you keep employees challenged without burning them in the speed of change?

There will be employees that cannot follow the pace of change and it is a bank’s responsibility to assist them in a role that better fits their personality or to provide training to bring the employee back on speed. Like it is the employee’s responsibility to grasp the tools and trainings provided by the bank, instead of hiding from change.

The leadership challenge

Leadership teams in banks, in most banks, are comprised of bankers. The digital age requires a better balance between bankers and technology people, also in a bank! You need people who know banking, and you need people that understand technology.

At KBC, it was Erik Luts, Chief Innovation Officer, that the fueled digital transformation. In the beginning, the organisation dominated by business people, with the influence of Erik, KBC achieved a more of a balance with technology people, and technology ideas.

In the beginning business and IT spoke with each other on a regular basis, today they work together in a team. Early on, people didn’t understand each other, today they cannot live without each other. Realising this requires strong leadership, with one at the front to set a new direction for the rest.

Benoit: “True leadership means you need to know your stuff, and you need to bring it in an authentic, genuine way. 53.000 will only move, will only follow if they observe that as a leader, you genuinely believe what you are preaching. It is not about the 300 people in innovation, but about making the 300 setting the direction of the remaining 52.700.

Innovation teams will not bring value. Value comes from the thousands of employees that keep ING running every day, with a customer-first attitude. Understanding the customer, having a vision on this over 20 years will also help in understanding which technology helps to facilitate that vision.”

A second crucial consideration is to make the organisation understand that failure is part of the journey, it is not something that breaks an employee’s career. If you create an environment where failure is not accepted, innovation cannot flourish.

Karin: “You learn by doing. We do projects, and we also learn what goes wrong, not only what goes right. Making a step is at least as important as the successes of an organisation.”

This culture is what real leaders in digital transformation will not only defend; they will fight for it! It will stimulate creativity, freedom and a happy work environment.

Karin: “Once you get your business empowered to think about great cases, change can happen. Think of the opportunities and then look at how to realise them. First, you need to imagine what is possible; from there you can make the organisation move to make it all happen.”

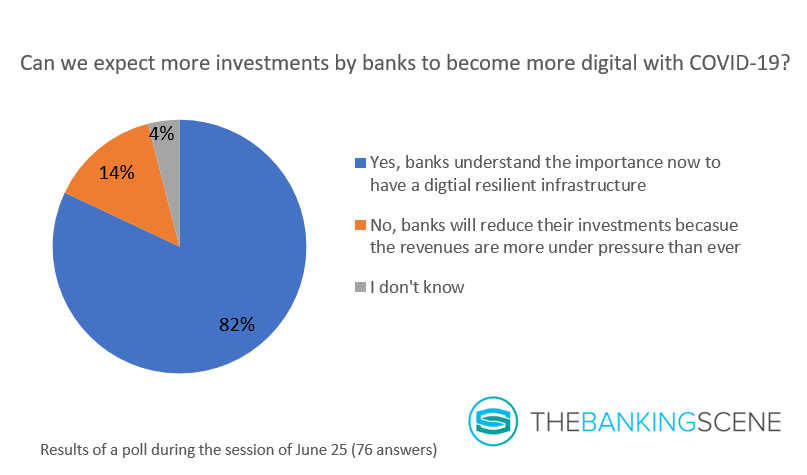

How did COVID-19 change the sense of urgency to invest in digital transformation?

The last poll asked how the audience believes COVID-19 will impact the investment appetite of banks in digital projects. 82% of the audience was convinced that banks will speed up their investments in digital transformation because of COVID-19.

It confirms one of the conclusions of our session on June 11, with Tink on the investments in open banking, where the audience and Jan van Vonno, said that COVID-19 will accelerate the investments in open banking.

To my surprise, the feedback of our council of wise was more nuanced. Every bank is currently revaluating its priorities right now, they said. For banks that are still early in their digital transformation, additional investments are not crucial to keep up. However, institutions that are already far ahead of the market may consider slowing down their more visionary and risky projects and build a buffer for the economic storm ahead of us.

Suddenly the race to be a digital frontrunner is not just about customer acquisition, revenue generation and cost reductions. Now the digital frontrunners can afford to slow down a bit and anticipate bad weather, whereas the followers need to use all the reserves to remain operationally resilient. These players can only hope the crisis will not turn out to become disastrous.

Conclusion

For me this edition was a big success, it learned me how great leaders make the digital transformation successful, not by explaining the tools they use, but about how to use them, how to make sure everyone uses them in the right way.

Based on the feedback, our international executive audience is on the same line on this with me. That is why I decided to set up an Indian Summer Event, talking about “Society and Banking in 2030”. More information on that session will be shared later this week. The line-up looks very promising again!