Insights & Opinions

4 possible scenarios for the bank branch in a post-COVID reality

Tue, 26 May 2020

We read it every day: the future of banking is digital, and the future of work will be more remotely. But what about bank branches? What should banks do with their branches, now digital banking is accelerating, now people are more reluctant to visit a branch, now they get used to digital services?

I haven’t read a lot about that. Do the same rules of head office employees apply for local bank branches? Or should branch employees keep working full time IN the office in the future? This is not a new discussion. Banks that have not yet figured out what to do with their branches are now faced with even more pressure.

That made me think: what are the possible futures of branches?

The many discussions and readings over the last few months gave me a few more insights, ideas and thoughts that may provide a few additional dimensions in answering this question.

What is the role of a branch?

Branches can fulfil several roles. Essentially most of these roles date back from the era of physical banking: it was a meeting place, and the only one to manage financial affairs. Most branches today have been there for ages, and still serve the same purpose.

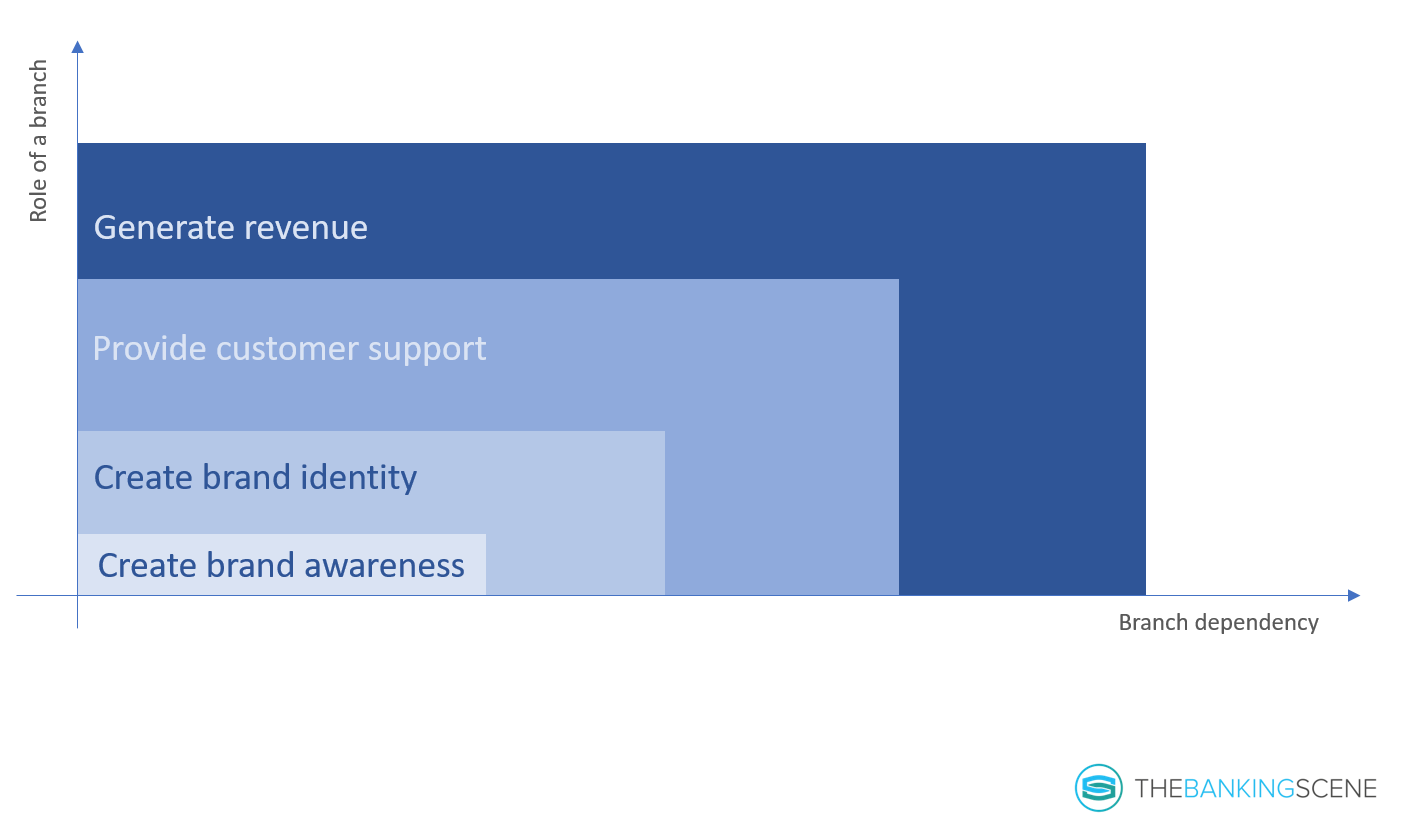

There are exceptions, and it is very interesting to see why these new branches were set up in the first place. It is not just incumbent banks that rolled out branch services. Let us have a look at what purpose branches serve. On a high-level I see 4 main categories:

Most new banks today start with a 100% online offering. Revolut, N26, NewB, bunq are just a few of them.

Create brand awareness

Some challenger banks start from day 1 with a 100% online offering and have a few flagship stores to promote the new services. Aion is such a bank (see my interview with one of their executive at their launch).

Aion, the reincarnation of Banca Monte Paschi di Belgio, but has been built up again from scratch to meet every single expectation of a digital bank. They have flagship stores to represent the brand, to demonstrate the products and services, to onboard new customers and to help them where needed.

Create a brand identity

Brand identity refers to the local anchoring of a bank, with the sole purpose to show they are there to serve the local economy. When smaller incumbent banks start expanding to new regions, a branch is saying “we are here to help, we feel with you”.

vdk bank recently expanded to my town Mechelen. A few months ago there was a new branch in town. Setting up a branch tell us, local citizens, that vdk bank is not just a bank from Ghent (where they originally come from), but that they are open for everyone.

What Aion bank did with the flagship stores is similar. With international shareholders and a management team that is predominantly Polish, their flagship store helps them to create a Belgian identity.

Provide customer support

Starling Bank is known as a 100% digital bank. They do not have branches, however… they do use branches. Starling Bank set up a partnership with Post Office, which has 11,500 branches, spread all over the UK. This agreement allows Starling Bank customers to deposit and to withdraw cash.

Starling Bank has the advantage of being locally present (brand awareness AND identity), and on top of that, they bring value to the customers that are still cash-dependent. As they don’t own the branch themselves, they don’t have to cover all the costs.

Most banks like to ditch branches because of these cash-dependent customers. The business case for branches is deep red if a bank would be using branches purely for transaction services. Adding the brand awareness of being visible in the street is probably not enough to make the case positive.

Generate revenue

This brings us to the most important role of a branch: being an additional sales channel. Most consumers prefer doing their daily banking in a digital environment already. Once they need more complex products, like loans, mortgages, investment products and insurance products, a branch still comes in handy.

Having branches is a smart move to increase sales when digital alone is not enough. Key is to find the right balance between the number of branches and the number of sales.

Banks are pushing hard to serve their customers digitally, also for more complex products. This shift takes time. Some banks are better in guiding their customers to the app or tablet than others.

COVID-19 forced many consumers to get that urgent mortgage loan through a video call or other alternative digital ways. This has helped the acceleration of shifting consumers to digital. But we are still far from a purely digital environment, and perhaps we never will. I mean, 15 years ago, I didn’t think that in 2020 I would still be going to a story. The stories I heard from Silicon Valley back then made me think that today all that would be done automatically.

So branches will not die anytime soon. They will be reduced, but they will not all disappear.

What are the possible futures of branches?

They remain as is

As I said: the hybrid model of digital services and branches, the so-called omnichannel experience will not disappear. So a first possible future of a branch is that it remains as it is right now: a flagship store or an extra channel to serve customers.

They support multiple bank brands

When the sales volume is not enough, banks could consider sharing the real estate cost. Image smaller villages where today 3 branches are making a loss.

Why can’t they work together, by sharing the available surface or of one branch with limited FTEs? Bank A open the branch on Monday, bank B uses it on Tuesday and Wednesday and bank C on Thursday and Friday.

Because the branch loses the role of brand ambassador, this is a less popular scenario. It also required a trusted partnership between direct competitors, which is not easy. On the other hand, we start to see similar joint venture models for ATMs as well, so why not consider this scenario?

They transform to local office hubs

Today most bank offices are concentrated in the big cities. Employees commute all through public transport and they all work in the same offices. Suppose there is a new breakout of a virus in that city, they have to leave ALL their employees back home again. As such, that is not a problem. If there is one thing we learned in this crisis, it is that banks are capable to act responsibly in this kind of situations.

Better safe than sorry: to improve their operational resilience, banks may conclude that they want to be less dependent on their head office. One way to do this is by pushing their employees to work from home.

Alternatively, they create local hubs, where employees still have social contact, but they are spread over the country. This way, virus outbreaks, or any other disaster, could be isolated, and the impact is potentially limited to a few hubs only.

“Even once the immediate threat has subsided, there will be a long-term adjustment about how we think about our locations,” said Jes Staley, CEO of Barclays. “The notion of putting 7000 people in a building may be a thing of the past”.

Instead, investment bankers and call centre workers could end up at smaller locations, such as branches, signalling an end to long commutes.”

This way, branches keep their role as a brand ambassador, and if required, they keep a limited surface for customer support and/or sales. At least part of the cost of maintaining a branch can now be transferred to other departments.

They transform to local innovation, entrepreneurial support hubs

When we think about banks supporting SMEs and entrepreneurs, we think of loans, payments, cash management… we think of financial products.

Some banks already extended this to a few offices that support start-ups and fintech. Why wouldn’t some banks extend this to any entrepreneur that looks for an office or a desk? Co-working spaces have a bright future, in my opinion, and banks have a lot of real estate. So why not transforming some of that real estate into new co-working places for people that no longer want to commute, but hate to work from home all day?

Imagine transforming a branch into a co-working space, with a small office, where financial advisors can help the entrepreneurs whenever needed. I see a lot of cohesion here for bank and entrepreneur.

Again, the branch acts as a brand ambassador but also as a sales channel, but in a limited way, as most of the services by new entrepreneurs will be preferably digital (as we learned in The Banking Scene Afterwork on May 7). To cover the cost of branches, they get the revenue out of rental services.

A combination of co-working space and local office hubs may be very compelling. The different impulses at the coffee machine (from internal and external sources, will potentially lead to a new wave of creativity and internal innovation. With Open Banking ahead of us, it is important to keep close contact with all kind of industries, not only by innovation teams. Everyone involved has the right to be inspired, to avoid any missed opportunity. This could be the right way to achieve that.

These are just a few possibilities probably, but a few that can fulfil the roles that branches have today, and at a lower cost, or with more value for the bank. Do you see other scenarios as well? Please let me know, so I can update the list. I look forward to discussing this more in detail!