Insights & Opinions

The Waterworks of Money: Banks at the Crossroads of Change

Mon, 25 Nov 2024

We can talk about a different world as much as we want. We can share opinions about what banks should do about that as much as we want, but if we don’t properly understand the bank’s position in the bigger picture, what are we discussing?

How Much Can Banks Influence The Waterworks of Money?

I’m almost halfway through my professional career before reaching the age of retirement. That professional life started 2 years before the financial crisis. It was the most disruptive force in our industry of the past decades, but it wasn’t the only one.

The banking industry slowly moved to surviving one crisis after another.

Slowly, because change takes time and patience in banking, maybe even more than elsewhere. It faced the threat of complex products and bankrupt banks, with fierce regulation and more supervision as a consequence. Fintech vibes brought the necessary digital transformations while more regulation came to the table.

Interest rates went down, and down, even below 0. It was never seen before. Banks needed to reinvent themselves to keep their heads above the water. “More fee income” and “More efficiency gains” were the board-level discussions between people who had never experienced low or negative interest rates before.

And then came COVID-19, and the inflation resulted from monetary decisions to keep the economy flying.

We are now 15 years after the financial crisis, and the people who make the decisions start to be people who didn’t live a life with high interest rates; they may not have worked for a bank that offered 3% or more on a savings account during their professional life.

These are exciting times, not just because of the new generation of bankers, but also because, as we investigate in next year’s conferences of The Banking Scene, we are witnessing a metamorphosis in banking: “Much like a caterpillar evolving into a butterfly, banks are undergoing an internal metamorphosis, reshaping their core structures, strategies, and cultures to thrive in a rapidly changing environment.”

Banks are taking the driver’s seat again and leaving their defensive position. Banks start to set their own destiny again. They learned from fintech companies and discussed more with regulators and supervisors to find the right balance between a free market and proper regulation. Banks met with stakeholder groups to understand their concerns with regard to the bank’s transformation over the past 20 years and the societal role they are expected to play.

But where is the balance between regulation to do good and a free market to do business? How can we ensure that the industry is doing the right thing in playing its public role? What contributions can we expect from banks to help water the economy and society?

That is what we discussed during The Banking Scene Art Night, on November 18. The term “thought-provoking” is often abused by AI-generated content. Still, in this case, it was the only right term to describe what the audience saw on stage in a co-presentation between Carlijn Kingma and Martijn van der Linden in a presentation “The Waterworks of Money”.

Reimagining Finance: A Deep Dive into Systemic Change and Alternative Futures

The Banking Scene Art Night 2024 delved deeply into how money flows in our financial ecosystem and the possibilities of transformative change. It blended critique with creativity to inspire fresh thinking about the future of finance. Through insightful discussions and powerful visual storytelling, the event illuminated systemic inequalities and introduced imaginative solutions to reshape societal and economic outcomes.

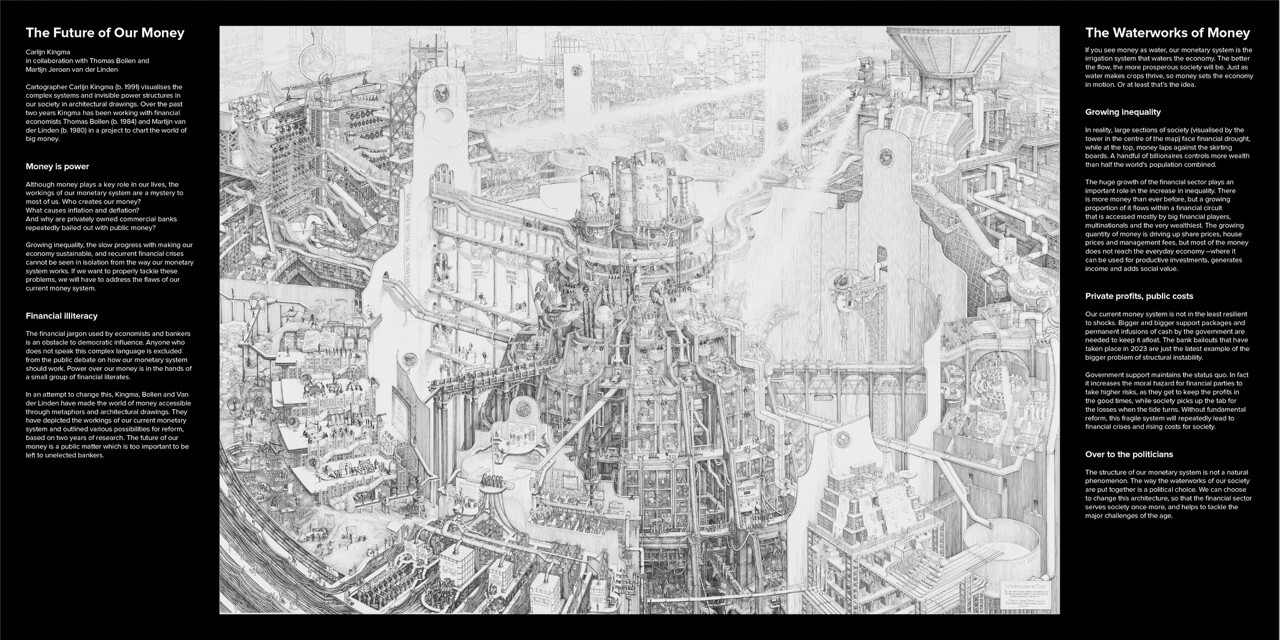

Carlijn Kingma drew The Waterworks of Money explaining how the distribution of money in society is unequally distributed. It was the result of endless talks and interviews with bankers, academics, journalists and many others. The input was used as input for the final task, which took her 2,200 hours to make: The Waterworks of Money, as you can see on the image below.

One recurring theme was the unequal access to liquidity. Financial systems are structured to prioritise wealthier participants, enabling large corporations and affluent individuals to access capital at low interest rates, while smaller businesses and the underprivileged face higher costs or outright exclusion. This bias not only stifles innovation but also exacerbates economic disparity.

Pension funds, often celebrated as pillars of financial security, were scrutinised for their reliance on speculative investments. For instance, Dutch pension funds manage assets worth multiple times the national economy, yet less than 7% of these assets are invested in real economic infrastructure like housing or sustainable projects. Instead, a significant portion flows through global financial markets, chasing high returns that often benefit intermediaries and exacerbate inequality rather than directly supporting societal needs.

Tax structures were another focal point, highlighting the disproportionate burden placed on labour compared to wealth and financial profits. While workers face high income taxes, those benefiting from capital gains and financial engineering often contribute far less to public revenue, intensifying the divide between rich and poor.

Mechanisms like quantitative easing, which inject liquidity into financial markets, disproportionately benefit large corporations and wealthy investors rather than addressing broader societal challenges. These policies often prioritise market stability over equitable economic development, further entrenching systemic inequities.

A common thread throughout these critiques was the lack of clear accountability within the financial ecosystem. Decision-making processes remain opaque, with limited public oversight. This disconnect not only undermines trust but also prevents meaningful reform, as stakeholders deflect responsibility for systemic shortcomings.

Envisioning Alternative Futures

As one of the speakers shared on social media afterwards: “Strategic foresight, dare to challenge and be challenged, ask yourself ‘what if’, get inspired by art, never be complacent, prepare the future for your (future) colleagues, shareholders, clients, society! This is the only way to grow, to create value and to inspire!”

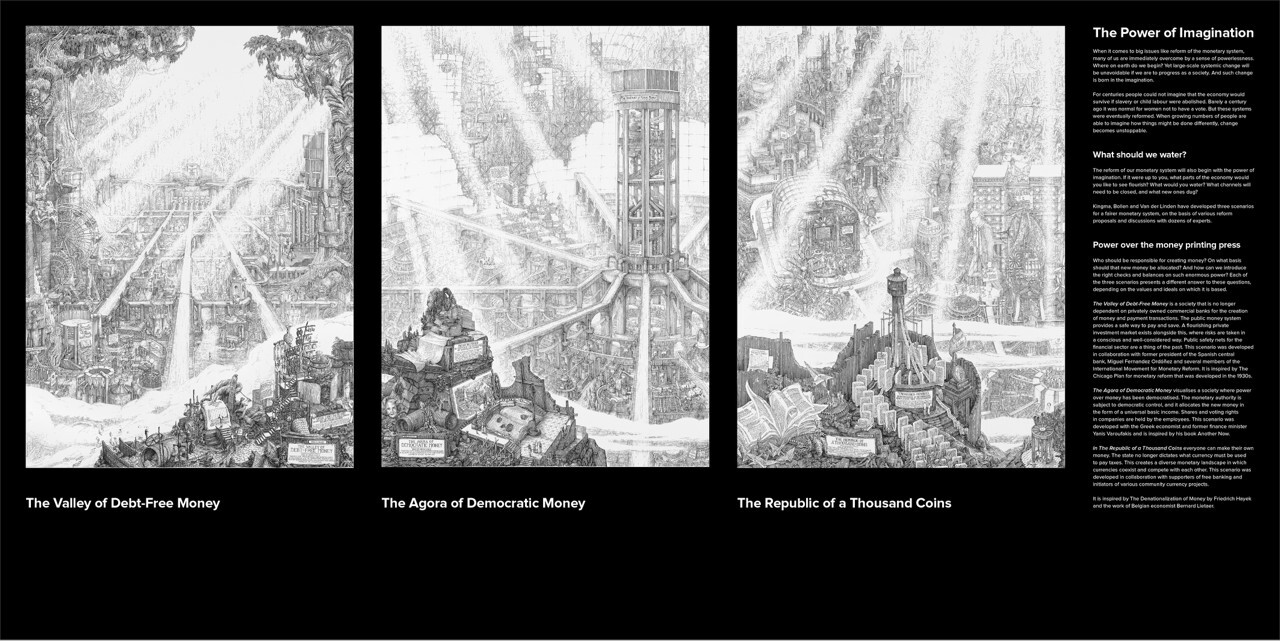

That is precisely what Carlijn Kingma and Martijn van der Linden did. Amidst the critique, the evening also offered hope, presenting bold and imaginative scenarios that redefined finance and society. These visions invited the audience to think beyond the constraints of conventional systems and embrace transformative change. It led to 3 more paintings and a lot of reflection on “what if”.

I’m not advocating for any of these scenarios as the ideal future, but I love those scenarios as a starting point for dialogue. One reason being that, although banks are critical in today’s system, it also shows that banks will not and should not reform that system. They are simply one of the players in the game, playing the rules of the game, defined by the system.

One vision proposed a system of debt-free money inspired by historic reform proposals. This approach decouples money creation from debt, allowing governments to issue money directly for public purposes such as education or sustainable development. By eliminating reliance on private banks to create money, this system promises greater stability and equitable access to financial resources.

Another scenario centres on democratising the economy. In this vision, corporate power is dismantled and replaced with citizen councils that oversee financial institutions and resource allocation. Companies operate under a "one person, one vote" principle, ensuring equitable participation in decision-making. Stock markets become relics of the past, replaced by community-driven economic systems that prioritise sustainability and social well-being.

A third vision explored the idea of currency diversity. Drawing inspiration from both historical and modern concepts, this scenario imagined a decentralised financial ecosystem where banks, communities, and individuals issue their own currencies. This diversity fosters innovation, resilience, and local economic growth, offering a stark contrast to the centralised control of today’s monetary systems.

Conclusion

The Banking Scene Art Night 2024 underscored the critical role banks play in shaping the financial ecosystem while highlighting that systemic reform requires collaboration across policymakers, regulators, and society. As stewards of economic growth, banks must balance their profit-driven objectives with their public responsibility to foster inclusion, innovation, and progress.

The scenarios presented by Carlijn Kingma and Martijn van der Linden invited us to rethink the financial system through lenses of equity and resilience. From debt-free money to democratised economies and currency diversity, these bold visions challenged us to imagine a system where financial flows are not only efficient but also aligned with broader societal goals.

Banks have a unique ability to influence positive change by directing capital toward projects that address long-term challenges and opportunities. Their public role extends beyond managing financial flows—it is about helping build a thriving society that balances economic vitality with shared prosperity. By aligning their strategies with this purpose, banks can redefine their impact, ensuring the waterworks of money flow equitably and effectively for generations to come.