Insights & Opinions

The Gold Standard of Wealth Management - The race for digital differentiation

Thu, 27 May 2021

A Refinitiv study looks at evolving investor data needs and digital expectations, concluding that firms urgently need to enhance their platform capabilities if they are to attract new assets and engender loyalty in existing relationships.

The digital opportunity

The advent of COVID-19 served to accelerate the pace of digital transformation in the wealth industry, creating a double-edged sword for many wealth platforms. On the one hand, enormous opportunities suddenly opened up for these platforms to cater to a growing appetite for online services amongst investors. On the other, a plethora of existing digital shortcomings were exposed.

Refinitiv’s latest global report, The Gold Standard of Wealth Management: The Race for Digital Differentiation, finds that many clients are feeling underwhelmed by their digital platform experiences since the start of the pandemic.

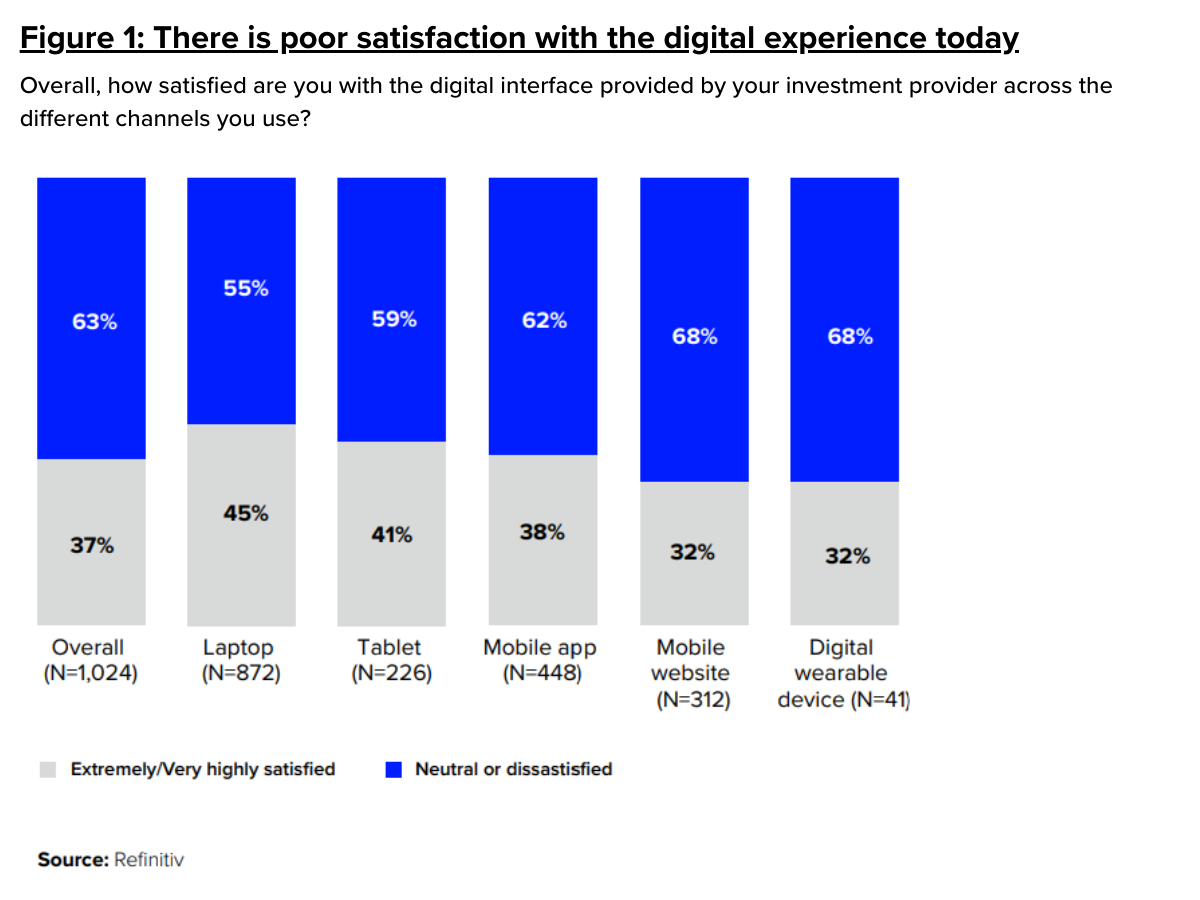

The report, based on a global survey of over 1000 self-directed and advised mass affluent investors, found that just 37% of investors across the globe give their provider top scores for the digital experience they currently deliver. Taking a look more closely at the mix of digital channels, 45% of investors surveyed give their provider top scores for the digital experience they provide when using laptops, followed by 41% for the digital experience when using a tablet (Figure 1).

Against this backdrop, wealth platforms have a clear opportunity to maximize revenue by optimizing the digital experience for users, and in so doing attract new assets and cement the loyalty of existing clients.

Digital experiences are lacking

The headline finding that platform capabilities fall far short of investor expectations is concerning.

Gaps highlighted include a lack of personalized insights; limited visibility into portfolio impacts based on market trends and news sentiment; and a lack of digital collaboration tools.

The good news is that some fairly simple enhancements could offer quick wins for wealth providers who are under pressure to figure out how to deliver these innovations quickly to attract new business and enjoy enhanced investor loyalty.

Loyalty is low and expectations are high

Poor digital experiences engender weak client loyalty, which ultimately impacts AUM as clients are tempted to switch providers.

Our study found that millennials are particularly concerned about digital capabilities. Millennials are three times more likely to consider switching platforms than other investors – and a key driver is the search for better digital experiences.

Loyalty is also low amongst the advisory client group, with a significant 20% saying that they would consider switching providers in the year ahead as a result of their platform experiences. This is double the number of self-directed investors who would consider switching.

These findings highlight the importance of a positive and engaging digital experience across client segments, but also shine a spotlight on the need to personalize the investing experience for the lucrative advisory segment.

Creating a compelling experience

Respondents were clear that a more compelling and valuable platform experience must be supported by comprehensive data to meet differing investment mandates.

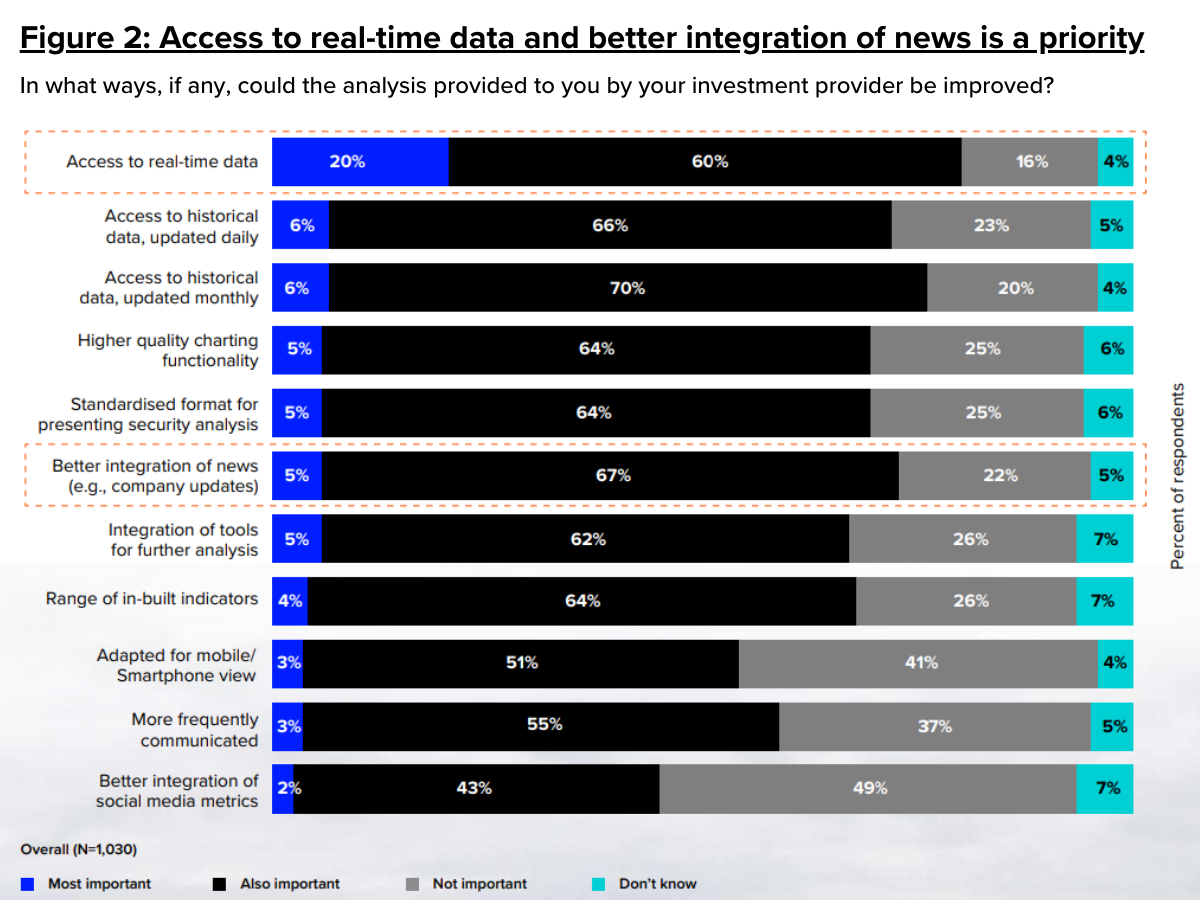

Clients are looking for more dynamic content as part of the digital experience, with a substantial 80% of all investors stating that real-time data is a priority enhancement they would welcome.

Also noteworthy is that there is a wide-spread need for support with contextualizing and making sense of incoming information: nearly three quarters (72%) of survey respondents selected better integration of news as a secondary priority (Figure 2).

Alerts also stood out as a key digital tool. Particularly during times of heightened volatility, alerts can be used to draw investor attention to news and industry insights that are relevant to their portfolios. Our survey shows that one in five investors globally is not receiving alerts they find helpful, once again signaling that there is a clear opportunity for wealth platforms to respond to investor needs and differentiate their digital offerings.

Our report concludes that platforms should concentrate on some key elements – including a personalized experience; better education and training for users; more options for digital collaboration (for example, real-time chats or video support); enhanced navigation and more targeted insights.

As investor data needs and digital expectations continue to evolve, the opportunity to deliver digital excellence as a differentiating factor should not be under-estimated. Given the accelerating pace of digital transformation currently evident, embracing this opportunity needs to become an urgent priority for wealth platforms.

- Download the full report: https://refini.tv/3fnmMQf

- Find out more about Refinitiv Wealth Management here.