Insights & Opinions

Strategic dilemmas in innovation in cards and payments

Thu, 29 Apr 2021

April 15 was a great day. With an international forum of experts, we discussed the hottest trends in payments. Our central was guest Peter Theunis, Co-CEO of Radar Payments. In the first blog of this session, we explained how people look at today’s disruptive forces in payments and cards.

For this article, I will start where the first one ended: “it is safe to say that a lot is moving in the fascinating world of payments, some dynamics faster than others. It is hard to predict what comes next and which horses to bet on. Will mobile payments grow further, or can we expect more invisible payment means anytime soon? Will we keep paying in euro or will it be a digital euro in the future, and how will this impact our payment behaviour and management?”

We learned that, despite low confidence in the success of EPI (European Payments Initiative), it is impossible to ignore it. The biggest card disruptor remains our mobile phone, but that does not mean that cards can be abolished anytime soon.

+50% of the audience believed that cards would be dead only by 2040 or later.

Do retail banks need to invest in payments?

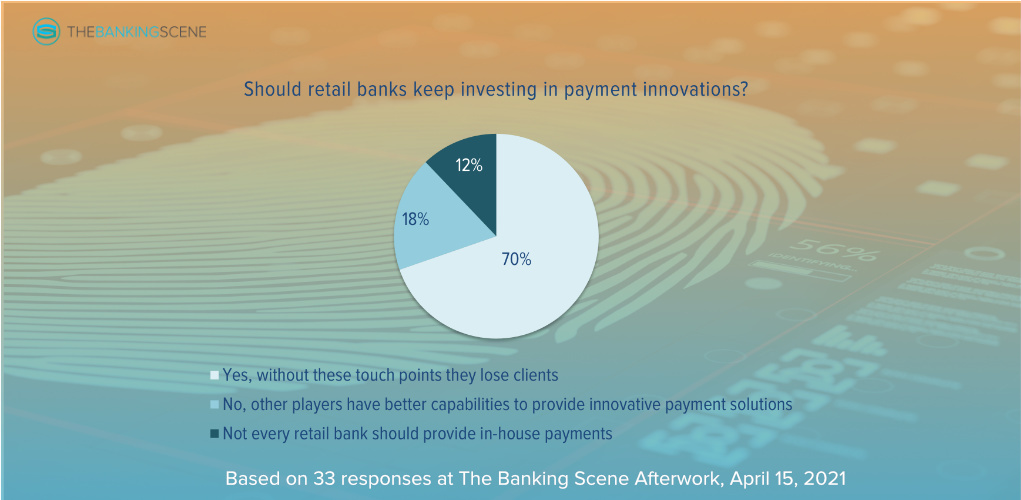

I didn’t share this in the first blog, but we started the session by asking our audience whether retail banks should keep investing in payment innovations? 70% of the audience agreed that retail banks should keep investing in payment innovations.

Although it may be a no-brainer, payments are getting so complex that by asking the question, you also think about the consequences. Indeed, a retail bank that outsources all of its payments activities may reduce complexity and cost, but it is also giving away customer insights, or at least sharing these insights with third-parties.

Peter Theunis explained: “I think a retail bank without payments and payments innovation is not a real retail bank. More interesting is to say: do the banks need to organise everything internally, as a white-label processor? I would say no.” The audience came with a similar statement, saying that working with more qualified companies to offer innovations may make banks innovation leaders at a reasonable cost.

So the question becomes: what should a retail bank keep doing internally, and what should it outsource? Each bank will have to find that balance for its own. Big retail banks can afford to take the lead in EPI, whereas smaller banks will wait, see and act, perhaps on a mutual basis. Smaller banks cannot afford to jump on every opportunity and need to select their investments wisely. If it does not add a competitive advantage, why not collaborate with others?

Creative ways to enter the customer’s wallet in a cost-effective way

In the session, we learned that cards are far from becoming extinct. In many regions, it is a confirmation of status for customers. Many banks see it as one of the last physical branding tools available as everything else is getting digital.

Cards remain the most important product of most neo- and challenger banks. Some of these even distribute the card before the customer onboarding. Anonymous cards and digital cards with reduced spending limit add the brand of the bank swiftly in the customer’s (e-)wallet. Once the usage reaches proper levels, the customer can get access to a personalised physical card.

Although digital cards have a lower cost, the intangibility risks reducing activity and revenues. If we can believe Peter, it is not before 2035 that we should expect mobile to take +30% market share in Europe of point of sale transactions.

Specifically, in the Belgian market, the perceived value of a debit card reduced to almost commodity. Customers are unwilling to pay for debit card services (which is why is it ‘added in a daily banking package’). The consequence of this is that banks look for ways to reduce the maintenance and processing cost of cards and card payments.

Adapting the neobank strategy of offering a digital card first will not change that. The cost reductions are minimal. So banks need to strategically investigate whether to do everything themselves.

Strategic considerations in the partner selection

Partnering with a third-party provider is more than just handing over part of the business case, explained Peter: having a partner you can rely upon gives a bank more eyes to look at the P&L and opportunities on the horizon.

Peter: “If you have to review a text that you have written yourself, you don’t find your errors anymore. Banks should also do what they’re good at, and that is selling financial products. They don’t need to build all their financial products.”

A white-label approach gives the outside world the impression that it is a 100% banking product. Choosing the right provider enables the bank to fall back on a top-notch platform with all the latest innovations that is running on a 24/7 basis according to all market standards.

“It will make for them life much easier. They’re not going to sit on a new legacy, giving them the freedom to choose”, explained Peter. “If a vendor does not do it well, you select another one after a while.”

It is much easier to hold an external party responsible for particular issues than internal IT. SLAs contractually stipulate each one’s responsibility and consequences if not everything goes according to the plan. The partnership is for a limited period of time, after which the contract is renegotiated. All this will keep vendors extremely focused.

Conclusion

Times are changing, and industry professionals need to keep their eyes open, not just for technology shifts but also customer expectations. It is a strength to acknowledge not being able to do all this alone. Collaboration is the way forward because it will help you reduce costs and streamline your organisation, but it will also give additional eyes to scan the market and make every link in the chain more responsible.

This is not just me saying this, but for example also Marc Lauwers, CEO of Argenta at one of our sessions: “Shared platforms and shared investments will allow them (savings banks) to mutualise the cost of operations and focus on what they are good at.”