Insights & Opinions

How Nickel Creates Financial Inclusion By Living To Its Values

Tue, 26 Jan 2021

Banking for Good, purposeful banking, ESG and other related terms is the talk of the corridors in the industry. At The Banking Scene, we have seen this coming for a couple of years. Instead of looking at all the possible frameworks that researchers and consultants set up, I decided to look for the concrete cases that make these topics more tangible.

That is why I decided to make “Banking for Good” one of the central themes during The Banking Scene Afterwork season 3, the first session being on January 21st, with the exceptional special guest, Thomas Courtois, CEO of Nickel.

Nickel, the neobank that lives to its values

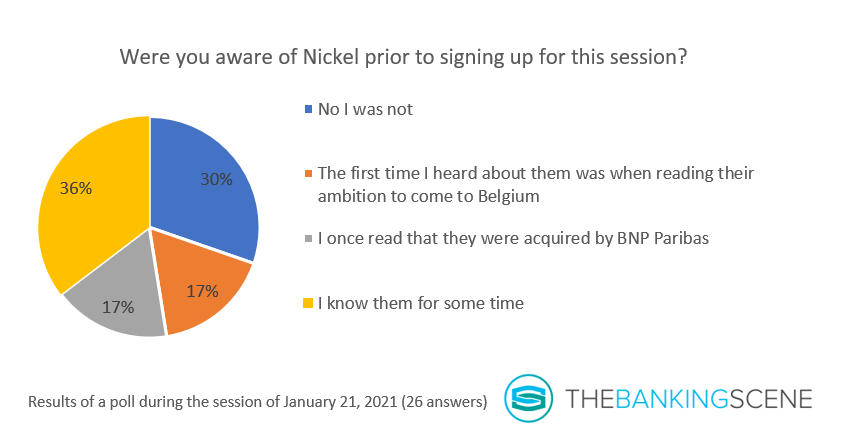

Nickel is a French neobank, serving a significant number of almost 2 million customers. Yet, the brand is relatively unknown. Nearly 50% of our audience only heard of them after their announcement to enter the Belgian market in 2022 (17%) or subscribing to this session (30%).

The company was founded in 2014 by Ryad Boulanouar and Hugues Le Bret to make society more financially included. Their motto was to provide an account for everyone. As the success outgrew their personal ambitions to create a profitable business for 150,000 customers, they sold the start-up to BNP Paribas in 2017.

Today they have activities in France and Spain, and they will add Portugal and Belgium on that list in 2022.

The baseline in everything they do is “universality, simplicity, utility and benevolence”.

Value 1: universality

It was unthinkable for the founders to leave people behind because of their nationality, the banking history of their revenues. So they decided to set up a bank for everyone, with all the essential services, and nothing more.

By limiting the services, they grow their market. People that were no longer welcome at a traditional bank, refugees, and everyone with sympathy to the brand can open an account, all at the same price, providing the same services.

Nickel is open to everyone, online via web and the app; on top of that, they count on an extensive physical distribution network of 6.000 outlets, predominantly Tobacconists in France and the National Lottery in Spain.

A recent partnership with Onfido allows them to onboard 190 different passports, resulting in a monthly onboarding of 5,000 foreigners, about 10% of their customer base. That is how universal their model is.

They distinguish 3 types of customers:

- People excluded from the traditional banking systems

- People looking for a straightforward offering without hidden fees or risky overdrafts on accounts (average yearly cost of daily banking in France is 250€, and for the 20% lowest earners it can add up to 420€)

- People looking for a safe, convenient and low-cost alternative for international travel and e-commerce

Thomas: “Today, more than 60% of our customers use the Nickel account for their primary bank account.” These customers fit in the first two types, as mentioned above.

Value 2: utility

“For us, financial inclusion is, above all, a matter of respect. Our promise to our customer is to allow them to pay and get paid. It is as simple as that.”

It is complicated to live without a bank account, today even more than yesterday. COVID-19 made the economy more digital at hyperspeed. People are entirely excluded from society without an account to receive a salary or social benefits, to pay bills, or that lack access to a card to participate in the digital economy.

For 20 euros per year, Nickel customers have access to all the required basic needs to spend and collect money for basic day-to-day banking, including an international MasterCard Debit card, a current account without an overdraft (not even optional), and all the required tooling to make and follow banking operations in real-time.

One could argue that Europe’s basic bank account service provides the same convenience and simplicity for European citizens. A second poll quantified the caveats of this service. 17% asked what the basic bank account is (keep in mind that respondents were all financial services professionals). Another 22% believed that the service is below the minimum.

The results were no surprise to Thomas. He rightfully argued “the basic bank account is an offer imposed by regulators to foster banks to have a dedicated offer for vulnerable clients. The positioning as ‘account of the poor’, can be perceived discriminative.” Moreover, there is no incentive whatsoever at the bank to promote the product, which explains its low awareness.

Thomas: “Nickel is not a side offer made for vulnerable people. We are convinced that we provide the best offer in terms of services, and quality, that treats everyone the same way.”

Value 3: simplicity

The tariff list with less than 20 lines illustrates the importance of simplicity and transparency for Nickel. The customer can rest on its laurels at the end of the year: overdraft fees will not result in additional hidden fees.

Simplicity and utility go and in hand at Nickel. Every innovation and product development comes with a reflection on the convenience of their services. When someone from the audience asked if Nickel is also actively looking at making their customers financially healthier, Thomas expressed that they are working on a PFM (personal finance management) tool, for as long as the service remains easy to use.

Thomas: “We want to help people without being too invasive. We know that somehow in the future, we will need to help them protect themselves from difficult times by assisting them with savings, for example. “

We discussed a previous financial inclusion session, where we invited microStart, a micro-lending company. Thomas understands that they also create a more financially included context and he confessed that maybe one day, they may be looking at lending services as well, on one condition though: “we will have to do it very differently from traditional banking credit and definitely very differently from personal finance companies. We will have to invent a new model, just like we did with the current account.”

Open banking is an excellent opportunity to broaden a (neo) bank’s services offering quickly. Again, Nickel investigates the options and is very selective in the investments. In September the launch of their remittance offering with Ria, in partnership with Monistap, proves that they are open to innovations, but only at the right conditions.

Value 4: benevolence

The last value is benevolence or how the company anchors itself in the community and contributes to making it better.

Nickel is achieving benevolence in multiple ways, the most obvious being: “To offer the best service at the best price for our customers. Despite the immense success we experienced, we never changed our tariffs since the very beginning. We didn’t try to sell more and more products to our customers. The services needed to remain very simple and answer the clients’ needs and not the need to increase our revenues per customer.”

Their customer experience and customer services centre is located in France, as a statement that they invest in local job creation.

Perhaps the strongest argument is their partnership model with local communities and associations, like Les Restaurants du Coeur, Action contre la Faim. In line with that, Thomas emphasised its network of tobacconists. Historically they are very dependent on a market in decline, tobacco, and Nickel helps them to find new revenues.

Next up: Belgium

They have all the building blocks in place for a European expansion. Thomas: “We are convinced that many European customers would like to have access to our services. Once again, Nickel is not a local solution but allows you to enjoy the best service at the best price.”

The first countries, in 2022, will be Portugal and Belgium.

Of course, Belgium isn’t France. Can they achieve the same success in Belgium?

According to the last poll in our session, the audience is convinced that there is a match. 26% believed that Nickel had all the ingredients to be successful, and another 48% thought that they have all the ingredients to be successful in particular niches.

Thomas is not afraid of the free of charge daily banking services that Belgian banks already provide today. He witnessed that “this is also the case in France, but we managed to take our share here because if a traditional banking service free, you can expect more hidden fees. With Nickel, pricing is all very transparent. You have no, absolutely no surprises.”

The news that bpost will sell its stake in bpost bank is seen as an opportunity for Nickel to partner with bpost, but Thomas believes in the coexistence of bpost bank and Nickel. According to him, they offer something completely different and complementary.

Would you like to attend one of our Afterwork sessions as well? Have a look at our program: The Banking Scene - Afterwork