Insights & Opinions

ESG Risk - How Belgian Financial Institutions Deal With the Implementation of the Regulatory Framework

Mon, 03 Apr 2023

Climate change, environmental degradation, social issues, and other ESG (Environmental, Social, and Governance) factors pose significant economic challenges. An increasing frequency and severity of extreme weather conditions (floods, hurricanes, wildfires) directly threaten businesses and communities, leading to economic losses. Recently, the Covid-19 pandemic reminded us that the global value chain and economy could crash in just a matter of weeks, bringing many sectors in danger.

The European Union has established various plans since the 2015 Paris Agreement to transition to a greener and more sustainable economy. To reach its Goal, it will leverage financial institutions' influence on the various economic actors to enforce a culture that integrates ESG concerns and factors. Initiatives, like the famous action plan on sustainable finance linked to sustainable investments or the delegated acts under the Markets in Financial Instruments Directive (MiFID II), were launched to achieve this.

The European Banking Authority (EBA) has been mandated with defining a set of rules to strengthen the consideration of ESG risks in the three pillars of Basel. A new version of the regulatory roadmap was published in December 2022, presenting the main objectives and next milestones of the regulatory evolution.

Little is documented on this recent regulation regarding the financial institution risk management framework, and its continuous evolution induces many challenges to the financial sector.

It is, therefore, an excellent occasion to assess how the Belgian financial institutions deal with it and identify their main difficulties.

Approach

In partnership with the Solvay Business School, Dynafin performed market research to investigate the relative level of maturity of ESG Risk framework implementation in Belgian Financial institutions.

The study performed qualitative interviews with credit Risk experts from 15 Belgian financial institutions. It assessed the maturity based on several axes of their Risk management framework related to the “E”, “S”, and “G” risks (Risk appetite, methodology, strategy,…), with a fair distribution of survey samples across the size of the institutions estimated by the size of their loan portfolio.

In the consolidated result for each dimension analysed, the maximum score was assigned to the most advanced institution, and then the others were compared to this benchmark.

This approach allows for a comparison of an entity's performance and progress in ESG risk management, as well as provides a better understanding of the differences between banks and identifies best practices for improving ESG risk management.

The interviews were also an excellent opportunity to highlight the main challenges faced by the various actors.

Results

The interviews performed were the opportunity to highlight several major trends:

Relative maturity

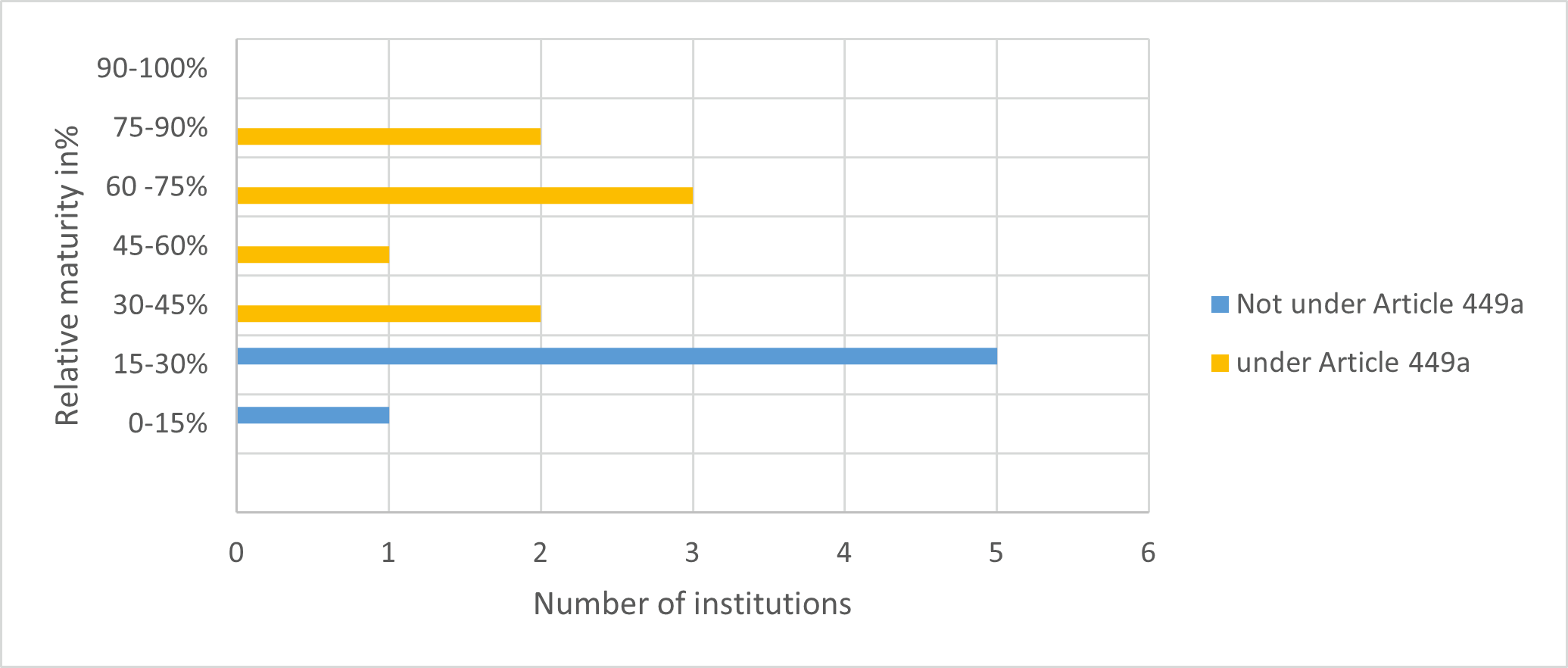

The global survey's findings provide compelling evidence of a significant trend: institutions subject to the EBA-CRR's Article 449a requirement to disclose their ESG risks are the most mature. This finding strongly suggests a correlation between regulatory obligations and institutions' resources to monitor their ESG risks. In other words, the EBA-CRR's disclosure obligation appears to be a catalyst for more proactive and comprehensive ESG risk management practices among institutions.

This finding is significant as it indicates that regulatory requirements can serve as a powerful driver for change in the financial industry and contribute to better ESG risk management practices across the sector.

Maturity by E/S/G

The study also found that all the institutions interviewed had implemented a structured framework for assessing environmental risks. However, the level of maturity in a structured framework for social and governance risks was either less developed or non-existent. This suggests that while financial institutions have recognised the importance of environmental risk management and have invested in frameworks for assessing and mitigating these risks, there is still room for improvement in managing social and governance risks.

Clear rules and guidelines from the regulator would help to establish a consistent approach to social and governance risk management, providing a common understanding of the risks and how to manage them effectively.

External support

Implementing an ESG risk framework can be complex and challenging for financial institutions. 90% of the institutions surveyed acknowledged this challenge and sought external support to help them comply with the regulatory requirements, understand and interpret the regulation, and/or provide dedicated expertise to implement a Risk framework.

Regulatory technology (RegTech) is a rapidly growing subsector within FinTech, driven by the increasing complexity of business operations and the regulatory regimes governing them, which are becoming more globally interconnected. RegTech has fully embraced ESG topics, developing clever and efficient solutions to help financial institutions manage ESG risks effectively.

However, the adoption of these new technologies is still relatively low, with only 30% of the surveyed institutions reporting working with dedicated fintech companies (other than data providers). This finding suggests that there is still room for more widespread adoption of RegTech solutions. Financial institutions that leverage these innovative solutions can gain a competitive advantage, enhance their ESG risk management practices, and improve their overall operational efficiency.

As ESG risks continue to evolve and gain importance in the financial industry, institutions need to keep pace with the latest technological developments to stay ahead of the curve.

Regulatory support

One interview question assessed whether the regulators in other jurisdictions were more or less supportive than the Belgian regulator regarding ESG risk management. Interestingly, all the international institutions interviewed answered this question negatively, indicating that they did not perceive the regulators in other jurisdictions as more supportive than the Belgian regulator.

This finding suggests that financial institutions may face similar challenges and regulatory requirements across different jurisdictions and that regulators in other countries may not necessarily be more lenient or accommodating regarding ESG risk management.

Challenges

The main challenges highlighted during the interview were the followings:

- Data collection: 100% of participants struggle to collect the right data, either due to the determination of pertinent information or due to difficulties in identifying the most relevant and accurate data sources.

- The unclarity of the regulation: A significant majority (80%) of participants perceive the ESG regulation as unclear. To the question “On a scale from 0-5, how clear are EBA ESG regulations for you?”, 70% of respondents gave a score greater or equal to 3/5. This suggests a need for greater transparency and clarity in ESG regulations, potentially through clearer guidelines and more practical rules.

- Data interpretation: Based on the data provided, it appears that 20% of participants expressed uncertainty regarding the different sources of information available to them and how to combine them effectively.

Conclusion

The topic is relatively new, and the EBA has a crucial role to play in providing more explicit and clear guidance in this area. This would enable banks to understand their ESG risk better and be better equipped to integrate them into their overall business framework.

While there have been positive developments regarding the "E" in ESG, the interpretation of regulations for the "S" and "G" aspects remains challenging, and more work is needed. With the rapid increase in the number of Fintech companies in the sector, they are likely to play an important role in advancing ESG goals, provided they receive adequate support from regulators.