Insights & Opinions

Dear bank: how do you avoid being part of AT Kearney’s 10%?

Mon, 27 May 2019

AT Kearney got the news last week. They predict that “One in ten European banks will disappear over the next five years”. The reason, according to them, is that “customers increasingly favour digital banks and innovative product and services. Branch closures is a short-term fix to steady the books but it isn’t enough — traditional institutions need to consider strategic transformation to improve cost and top line and also offer more innovative products and services”.

Febelfin is not surprised by this, they added: “Since 2010 28% of banks disappeared from the Eurozone”. As such the 10% decrease is not a surprising number. The banking sector is faced with enormous challenges they say: low interest margins, new regulations, new competitions, changing customer expectations.

This is nothing new. 2 years ago, I organised my first conference of The Banking Scene. My introduction was all about that, and it wasn’t even new at that moment. We are now 2 years later and the industry keeps looking for an answer.

Of course we will see a consolidation in the market in the coming years. I disagree that the consolidation is because consumers want innovative products. They don’t… they want good products, fit for purpose. And they want advisors that can help them the best way possible. Digital is the answer for many customers, that is definitely true. It bring services closer to the customer, right in his/her pocket most of the time.

This is why also incumbents invest massively in digital services. The investments are huge, the stake as well, the return is often questionable. Most banks follow what others are doing as well, they copy the best ideas and give it another colour.

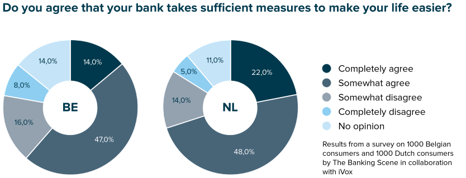

Banks are doing a good job according to a recent study by The Banking Scene, at least according to consumers. For a sustainable business you need one extra element of course: profits!

So the key question is: are banks taking sufficient measures to make consumers pay for making their lives easier?

How are banks today truly differentiating themselves from competition? How many banks do you know that still have this unique identity? Those specific products and services for which only they are known for?

In the past the closest branch was the bank where you opened an account. Decades ago, every city had its own bank. Each had their value proposition, mostly based on their location and the personal service.

The first wave of consolidation started and this resulted in a new banking landscape with many local banks and a few big banks. Banks were growing closer.

Along came the internet, and mobile banking. Today everyone is online, often with more or less the same services and products and with increasingly less personal contact, because ‘we need to rationalise our costs’. On top of that banks evolved from their branch to their app, going from highly visible to not at all physically visible.

Most play on price, a race to the bottom. Consequence: lower margins. Lower margins lead to less cost cutting and cost cutting reduces the energy that can be spent on creativity.

A few banks push hard for the best possible service, or the most personal approach, the highest accessibility… That is great, they find a way to remain relevant for their clientele, they know how to attract the right customers.

Open Banking will open new opportunities for these players, it will create new rules on how to play the game. Services get less transparent in a world of ‘everywhere’ banking and a hyper connected world.

Can you keep up producing your own products, or will you start looking for collaborations, sometimes for the most basic products, like Starling does for its deposit products?

The early days were easy: you go to a branch of the competition, and you find a tariff list with all services and prices. Today that is made even easier: you find them on the website of the respective bank. That is: prices consumers have to pay for the products that are offered. With the rise of Open Banking, new revenue streams appear, a lot less transparent, because banks start serving third parties as well.

The 10% banks that will disappear are the banks they cannot find an answer the question what makes them still relevant. They don’t find an answer on how to make sufficient money out of banking, because they became a commodity sales channel of commodity services.

It is a tough question, I am well aware of that. That is also why we decided to have ‘Banking for Humanity’ as a key theme this year at The Banking Scene. This debate is more actual than ever: if you are no longer banking for the sake of humanity, then why are you still in business?

Some banks understand this. Like for example De Volksbank. Esther Stegman was pretty clear at The Banking Scene: “Banking is at its core a human affair whereby money is only a means, but the ultimate goals are: financially resilient customers and a sustainable society, now and always. That is why we don’t hit at short-term financial gain. We aim at the long term, and more specifically: at a long-term average return.”

The same is true by the way for technology: it is just a means to an end. That is why I don’t really agree with AT Kearney when they say that consumers look for innovation. No… they look for convenience and support. They look for tailored products.