Insights & Opinions

Banking is about Realising Dreams - A look at how KBC and Doconomy go the extra mile

Mon, 09 Sep 2024

"Banking is about realising dreams."

I use the phrase to explain in the most positive way what banking is about, inspired by others. Banks allow people to buy things they can only afford many years later, like a house. They let people earn money by putting their savings aside. Thanks to banks, we can travel across the world, and wherever we go, they allow us to pay and be paid. If a company faces a cash flow problem, but it isn’t a structural issue, banks are there to help.

So, as much as it sounds a bit idealistic in light of the regular press that focuses on profitability and misbehaviours, banking is about realising dreams. In a way, that is also what my first book will be about.

So last week, when a friend raised my awareness of KBC’s latest announcement, I had to see what was going on.

“Whether it’s a new game, scuba diving gear or an unforgettable holiday, make your dream come true in KBC Mobile! Create your dream, save for it with the help of our savings boosters and get there in no time. All set to go?”

I was set to go!

Before I go into the details, I’d like to share my overall conclusions first.

KBC is Realising Dreams

Saving can be a challenging mission for some, despite the many dreams everyone has. Not everyone has a good relationship with money. In that respect, I can only praise this initiative. The fact that people can visualise their dreams is not revolutionary but helpful in keeping someone disciplined in achieving the dream. It “storyfies” the dream, as I call it: people can anchor the discipline of saving to a tangible and visual goal. That surely helps, but it is only the start.

KBC and Doconomy go the extra mile by nudging people in the right direction beyond the classic savings plans. This is great because they give examples of how to lead a more modest life to achieve dreams faster. The bank can activate a change in behaviour by reducing expenses and making suggestions to earn more.

I remember Didid. This initiative was launched as a separate platform but was founded by BNP Paribas Fortis with the same mission and logic. Unfortunately, it was launched right before COVID-19, and because it was decoupled from a bank platform, it depended heavily on the success of Open Banking and PSD2. It didn’t have a long life.

The fact that KBC Bank keeps it in their mobile platform is definitely a plus, in my opinion, as it makes the solution a much lower-threshold to start with, at least for customers of KBC Bank.

Fun fact: KBC is using the technology of Dreams Technology, acquired by Doconomy in February 2023. One of the shareholders before the acquisition was… BNP Paribas.

How it works

The website told me to log in to KBC Mobile and to scroll to “Income and expenditure” on the start screen. I overlooked that option (my bad!), but Kate, my virtual assistant, was there to the rescue. She helped me find “Saving for Your Dreams”.

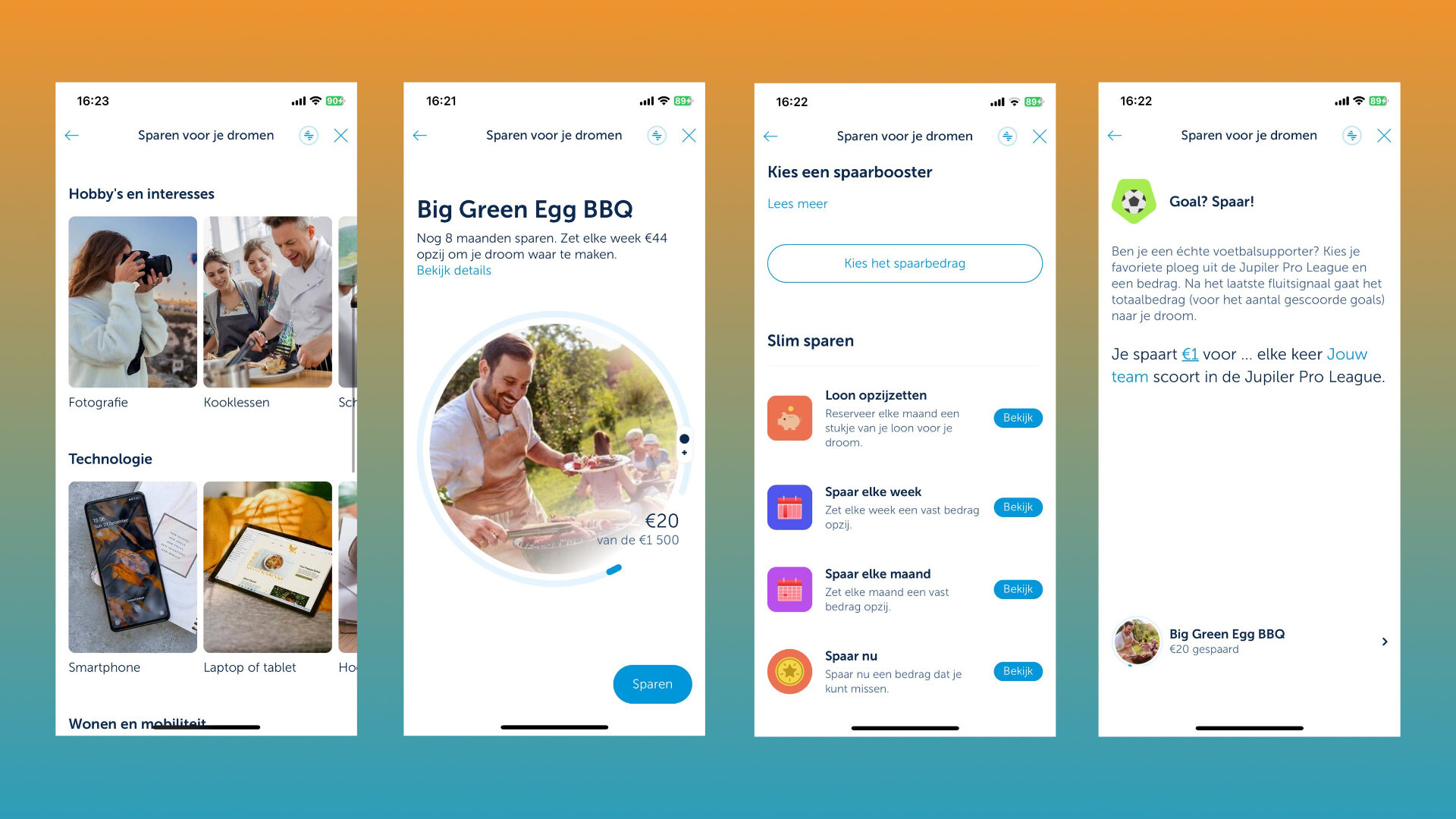

I got into the tool, and in different categories, I was offered exciting dreams with an image to visualise them. If my dreams weren’t there, I could still create my own dreams. Wonderful!

As a test, I selected “BBQ”, which brought me to a new screen with a nice picture, of someone BBQing. Some may see the dream as having a great BBQ with friends, others may like to buy a new BBQ. Luckily, the visual can easily be personalised by replacing the picture, and the title can also be changed.

The new dream has 3 fields to fill in:

- the name, which I changed from “BBQ” to “Big Green EGG BBQ “

- how much I want to save, where I filled in “1.500€”

- when I want to realise the dream, where I added May 1, 2025

Now, I can create the dream, and we can start dreaming and start saving. KBC Bank is very proactive in helping me save, some more relevant than others.

Choosing my dream and starting to realise it.

Choosing my dream and starting to realise it.

The option to boost saving

I used the “save booster” feature to transfer 20€ instantly to my savings account. A notification popped up indicating that I have 8 months remaining, and I should be able to reach my goal by saving 43€ every week.

There are multiple "Save smart" options, such as setting aside a portion of your salary on a specific day of the month with a specific amount, saving a set amount every week on a specific day, and a monthly saving option, which seems similar to setting aside a portion of your salary.

Unfortunately, the dashboard doesn’t change if I set a weekly plan of 50€.

You can enjoy fun savings by setting up a savings goal for every time your favourite Belgian football team scores. You just need to add the team name and the amount you want to save with every football goal. Alternatively, you can set up a weekly automatic surprise saving where you specify a minimum and maximum amount to set aside.

Some more interesting suggestions in the category “spend less” require a bit more attention. The suggestions include taking sandwiches to work instead of buying lunch or cooking instead of ordering food. However, you will need to calculate the impact yourself. These are one-time options similar to the aforementioned saving booster. So, every time I take sandwiches, I must remember to add the savings.

A third option here is a review of subscriptions. Again, it only works with one-offs, not even monthly savings, to my surprise. That is a bit unfortunate, but maybe that is because KBC is not my main bank and I don’t have any subscription on my retail account.

Earn more is a new set of options with a couple of suggestions, like selling clothes you don’t use, finding a side hustle etc… all with one-off save boosters.

Then there are a few options to gratify good behaviour, like taking the bike instead of the car for work or rewarding yourself every time you make your 10,000 steps, for example. It comes with one-off save booster, so no link with Strava or another tool to save automatically.

Finally, there is the option to create your own booster.

All nice features, but all in all, a bit dumb, or at least much less smart than expected.

KBC is Realising Dreams, but…

What I do hope is that this is just the start of something more dynamic. There are a lot of suggestions to dream for, but the tool will not give any insights or indications about how realistic a dream is, or even how much it would cost to realise the dream. I know as a bank, we should be cautious about what to suggest, but working with Doconomy, which acquired Dreams, a company that did only this, I had higher expectations.

In terms of modelling, I was hoping for a bit more as well. Most salaries can easily be recognised by the bank, so why can’t the system work with those interpretations instead of me having to have a date and an amount instead?

Perhaps a bit far-fetched, but if I want to give myself a bonus after a good exercise, isn’t it possible to link an IFTTT (If This Then That) with Strava or Fitbit, for example, to save automatically, as Qapital or Monzo did.

I would also expect the possibility of a recurrent payment to model the budgetary impact of making sandwiches instead of buying lunch. The side hustle earnings will most likely come from the same account each time, so it may be possible to add rules based on accounts.

Everyone is talking about AI these days, and also about the challenges and risks of using too much AI. Banks have an incredible amount of data, and although it comes with a risk of making too many insights available to the client (some may be wrong), I hope that smarter rule-based saving will gradually be added to the tool as well.

I believe that KBC has something valuable, not only in making saving more enjoyable, but also in improving people's financial well-being. This will require an extra layer of financial well-being, but with Doconomy's expertise in the psychology behind financial well-being and its technology to enhance it, combined with KBC's customer base and local market knowledge, there is definitely an opportunity for them to “Redefine their ethos” in that respect.

I cannot wait to see how this will evolve in the coming years.

Download our latest white paper, "The Future of Banking Engagement", for insights from over 70 financial services professionals across more than 60 different organisations on "The Paradigm Shift in Banking and Payments—Transforming the Rules of Engagement" - the theme of our conferences in Luxembourg, Amsterdam and Brussels in 2024.