Insights & Opinions

Automation is Making Banking More Human Again

Mon, 13 Jul 2020

I am a fan of making banking more human. I believe that a human, personal approach makes the industry better, both from an employee, for a customer and from a societal perspective. It may sound contradictive, but digital services are crucial to make banking more human again according to me.

So when UiPath suggested talking about ‘making banking human with automation’ I was thrilled to add them in our Afterwork series. The result was a highly engaging virtual round table session with two experts from UiPath, Amit Kumar (Senior Director Financial Services) and Guy Kirkwood (Chief Evangelist), and an engaging audience that joined the debate.

What we found is that automation is making banking more human, at least already on three fronts:

- Automation makes happy employees: the organisation can make better use of its human capital

- Automation makes happy customers: they get faster service, more personalised and fit for the digital age

- The programming language is even human, based on semantics, giving business full control over their business rules.

Robotics Process Automation (RPA) is booming these days. To give you an idea: UiPath grew the last five years from 26 employees with a total $1 million in revenues to 3.500 employees that generate $300 million in revenues.

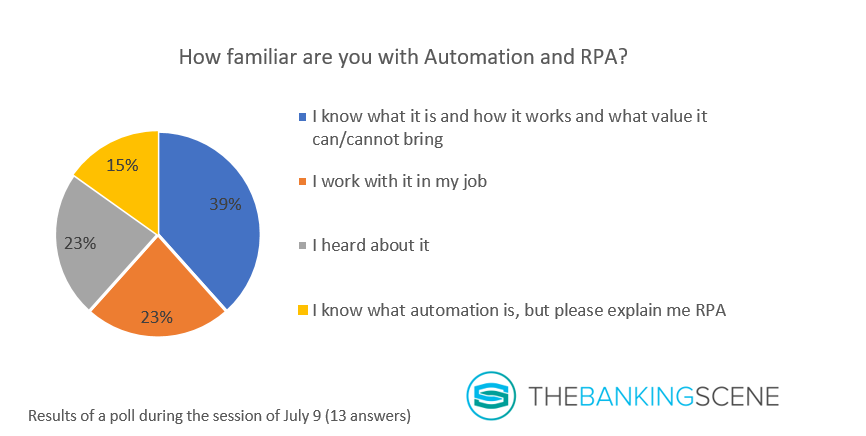

As the technology matured, so did the story of RPA. This is a slow but steady process that is shifting from a technical to a business audience. The first poll of our session showed that most people do know the basics, but there is still a lot of room for education, with this Afterwork session being another step in that direction.

Defining RPA

Guy’s rough definition of RPA is “that RPA is the automation of the shitty, scrap stuff that you don’t want to do in the first place.” Google defines Robotic process automation (RPA) as “the term used for software tools that partially or fully automate human activities that are manual, rule-based, and repetitive”.

Amit added that in today’s context, RPA is more than that. New technologies, smarter Artificial Intelligence, and a lot more experience with RPA extended the possibilities to more than simple repetitive tasks.

Today, RPA is capable of detecting not just structured data. Semi-structured documents and email have no secrets anymore in an automated process. Even some tasks that require a certain judgement are ripe for automation, said Amit.

More human customer experience

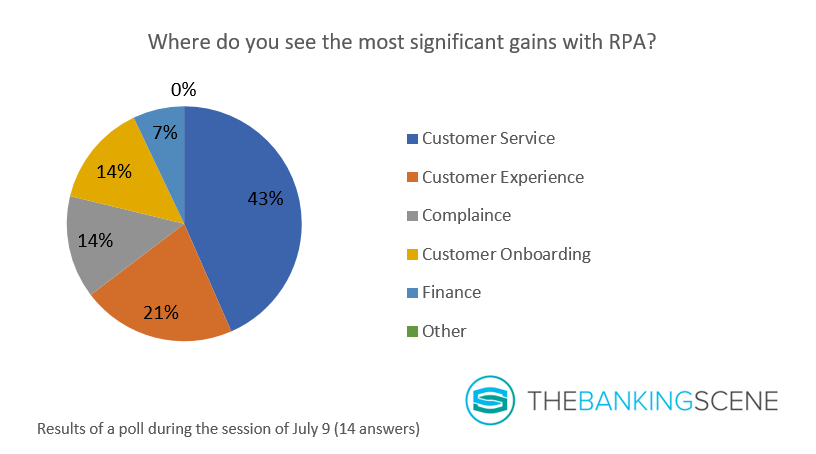

From the second poll, we conclude that automation is beneficial across the organisation, with the most significant gains at the customer-facing services, according to the audience:

Gains come from impact to the organisation, not just to bottom line, but also top line. That top-line today is connected with customer experience. Automation can create incredible results in shortening turnaround time of customer service, and that will immediately create customer delight.

This is where automation makes banking human: instant responses make happy customers, make service more human. Most of the regular customer services questions can be answered immediately in a well-implemented automation of the process.

Amit: “Mortgage loans are one of the most documented processes of a bank, with weeks of work before you get an answer from your bank. You just wait. Using technologies like OCR, natural language understanding and machine learning, the computer can first of classify and then extract data out of these packages.

Toady in COVID-19, many mortgage lenders need additional support for a refinancing, delay payments, or even a reverse mortgage. These people cannot wait for an answer from their bank; they need support immediately.”

Our session on “SME Banking will never be the same again” found that challenger banks, fintech and digital banks had the capabilities to set up new automated processes in an omnichannel experience quickly, often in just a few days.

UiPath is now in contact with many incumbents that missed the train and want to get back on track to avoid a similar scenario in the future.

Human programming language

Here the thing: you don’t need a tremendous amount of money, only the will to succeed and to act, to change, quickly. Whether you are an incumbent or a challenger, RPA can help. What people often forget is that you can keep the old technology and it operates on exactly way human do, so on a user interface level.

Change management and getting your people behind the automation project is more important than the technology challenge. It is what we heard in the sessions on “Doing Digital — Lessons from Leaders” and it is the main message today. The experience of UiPath is that the best way to achieve this is to work with a centre to excellence in the middle. They help to spread the knowledge AND the appetite towards automation across the organisation.

Earlier, the documentation ahead of an implementation would start with mundane interviews to better understand how the workflow would look like. Today you have sophisticated recorders that allow to mine data to create those workflows that exist today.

This means that you need:

- a few days to have the current process ready

- a few days for a bit of finetuning to streamline for the new, automated situation

- a few days to build the new process

- a couple of days for testing and deployment

That way the implementation process reduced from 5–8 weeks to about 5–8 days, end-to-end for a regular universal incumbent bank.

What is more: developing automations today has never been easier. After implementation, the business can be in full control of the business rules. Non-technical users are capable of setting up automations because of the intuitive nature of the technology.

The rules today are based on semantics. I explained in a blog early 2019 that “Semantic Technologies allow us to implement systems, to adapt business rules, to integrate services at the level of conceptual meaning, instead of the level of a structural code (which is what traditional technology relies on)… This layer is not a technical layer but a business layer.”

If you understand English, you can interpret and understand the instructions used to set up the rules. The instructions today are as simple as: “open an outlook attachment” instead of developing ten lines of code.

More human HR

What this essentially means is that dull, mundane tasks can be taken over by the computer and personnel saves time to invest in more valuable contributions to the organisation. Multiple evaluations have shown that an organisation that invests in automation ends up with happier, more engaged employees. The reason is simple: they no longer have to do the bits of their job they just had to do.

Guy: “Employee engagement is the stuff you do that you think is important for your job to make the organisation thrive. If you do more of that, the employee engagement goes up. Adding upon that: there is a direct correlation between employee engagement and customer experience.”

An executive of a bank that works with UiPath said: “Since we implemented automation, the mood music of business has changed. We have happier employees, and we now measure our services in terms of compliments rather than complaints”. This is an incredibly strong message. They made the KPI from something negative to a delightful number.

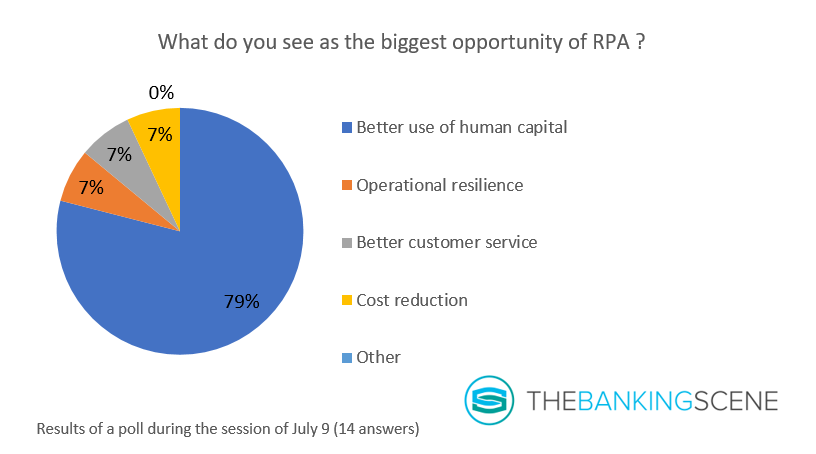

The biggest opportunity of RPA today is a better use of human capital. That is not me saying this, but the audience of our Afterwork session:

Amit: “Better usage of human capital will thrive the rest of the options that are listed here (in the poll). Performing value-added services help to build better customer experience, at a lower cost, and that will build time and bandwidth for better operational resilience.”

Guy illustrated this with an example from Sintel, in Singapore how essential and relevant smarter use of human capital is. Sintel had a lady working on reporting for the board for thirty years. For thirty years she collected information from all kind of sources and systems. As a non-technical profile, she invested a lot of time in developing her own robot, to create automated reports.

She won an award for that from her employer because suddenly she could provide 30 years worth of work in just minutes. She interacts a lot more with her board than she did before and in her role, she evolved from a simple reporter of results to an analyst and advisor, with substantial additional value for the company, and two promotions already since the implementation.

Conclusion

I was hesitant to add RPA on the agenda of the Afterwork sessions before we agreed on the topic because most of the talks on this topic are very technical as if a rule-based topic required a ‘rule-based’ conversation. Very quickly, I understood that RPA has outgrown this in a short timeframe of only a few years.

Coming back to the question: is automation making banking more human? I am convinced it is: it helps to treat employees on a more human way, by supporting the company to stimulating people to more fulfilling jobs. Automation is no longer purely about cost-cutting; it increases productivity, and it allows more variable productivity without too much impact on the cost side. A short sharp peak in work is no longer creating a peak in the labour costs related to that process.

In times like these, with suddenly many customers requiring exceptional support, automation helps to serve these customers in an instant, human way. That is what customers expect. A bank that is incapable of providing the service risks severe reputational damage.

So yes: automation is making banking more human, and I am thrilled that Amit and Guy were there to assist us in finding the answer to that question.